Strength and Characteristics of the M&A market

Mergers and Acquisitions (M&A), one of the major facets of capital markets and corporate financing, can be defined simply as the consolidation of companies. To differentiate the two terms, a Merger occurs when two companies combine to form one, and an Acquisition occurs when one company buys another. Shareholder benefits to companies involved in Mergers & Acquisitions may include improved economies of scale, increased market share, more fluid distribution networks, and reduced labor costs. In addition, investors who own shares in a takeover target can typically profit from a substantial price increase at the time of announcement. Deal-making activity between companies typically accelerates towards the end of the business cycle, when the stock and credit markets are usually strong and companies look to show continued growth. Through the third quarter of 2017 we have witnessed 99 takeovers of publicly [1] traded companies. It is also worth noting that a majority of the acquisition targets are small to mid capitalization[2] in size, an area of the market where Anchor has historically dedicated research and investment capabilities.

Cyclical rate of M&A

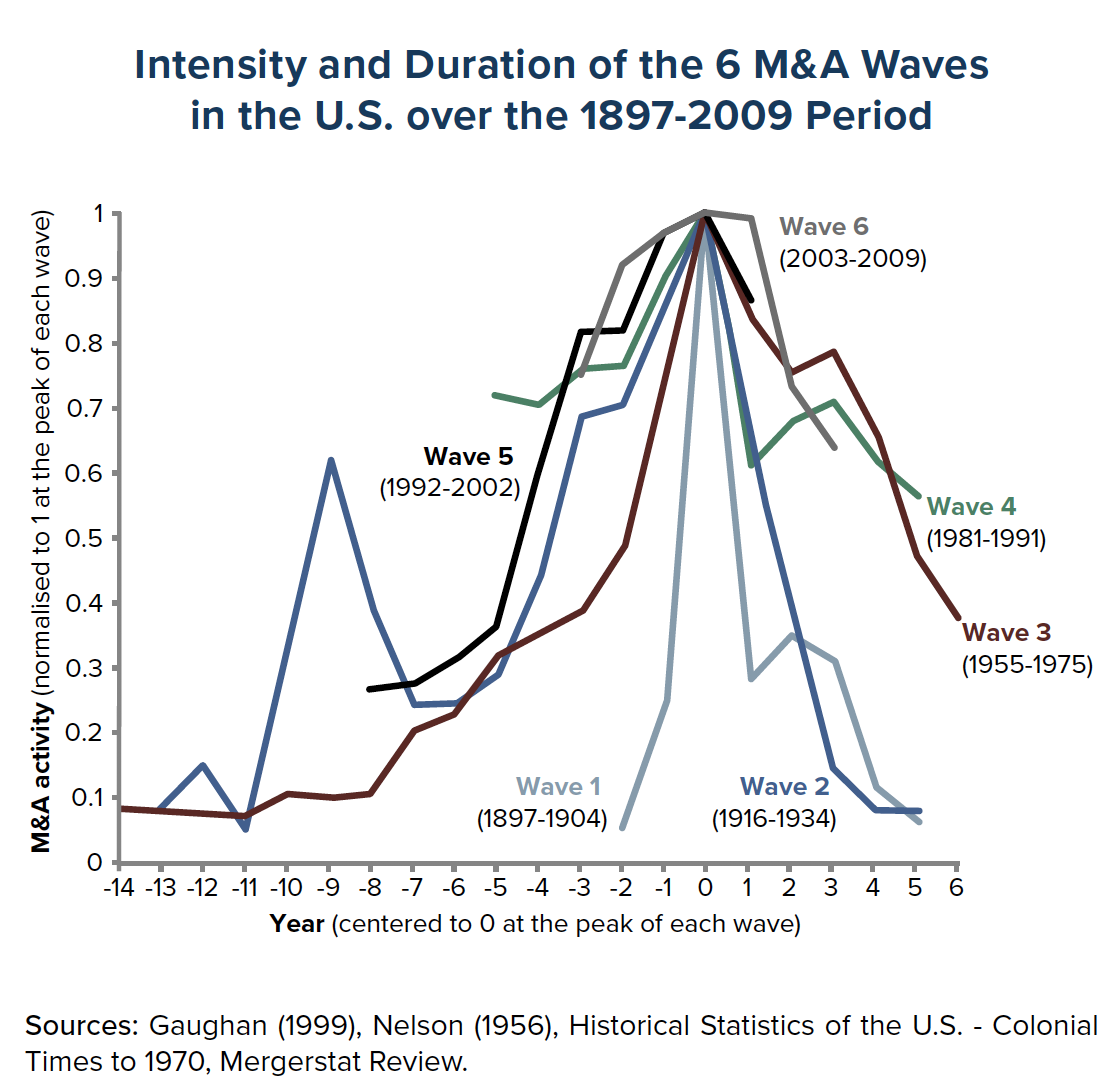

M&A activity is cyclical. Since 1900, markets have seen six M&A waves. [4] We believe each wave featured a defining characteristic such as rapid technological or industrial change, deregulation, financial innovation (i.e, leveraged buyouts), and globalization. Each wave also eventually ended in a breakdown in the markets.[4] The chart below shows the intensity and duration of six M&A waves that occurred up through 2009. Since 2009 the current wave is even more intense based on both number of deals and deal value.

The current wave, which has been ongoing since the financial crisis of 2008/2009, has focused on capturing growth and economies of scale. In reviewing various management comments on the announcement of an acquisition, we hear similar themes that an acquisition “strengthens and diversifies our business” and “accelerates our growth”. [5] The acquired company has an “experienced management team”,5 “extends our market position… [with] manufacturing, sales and operating synergies” [6] and “expands our profitability”. [7]

Why has the M&A market heated up?

Since 2008, U.S. growth has been lower than previous decades, running at approximately 2.1%.[8] In our opinion, this lower growth environment along with the pain of the 2008/2009 recession drove many companies to reduce costs, maximize cash flow, limit capacity additions, and preserve or buy market share. Coming out of the recession allowed companies to aggressively cut costs, thus increasing operating margins and generate record levels of cash. [9] Now, during this later stage of the business cycle, we find that companies are exploring alternative ways to grow. In some cases, technology and demographic preferences are rapidly changing industries, requiring consolidation for survival. In other cases, acquisitions can allow for top-line growth, market share capture, and expectations of synergies. With U.S. corporations currently holding more than $1.5 trillion in cash,[9] we think this M&A boom is likely to continue.

How M&A benefits Anchor

Anchor Capital does not invest based on a takeover thesis. However, over our investing history we’ve had our share of portfolio holdings acquired by large corporate buyers, private equity players, and even management-led buyouts. Our investment philosophy and process often lends itself to looking for the same characteristics that a strategic buyer or private equity buyer would seek in a company. In small to mid capitalization sized companies, we tend to focus on those that generate high cash flow and high returns on capital, with low leverage and a perceived competitive advantage. We believe these factors along with our long holding periods have allowed our portfolios to benefit from deal activity. The M&A market is cyclical and while conditions can change we expect deal activity to continue in the future.

Click here to download a PDF of this article.