The views expressed are those of Anchor Capital Advisors, LLC (“Anchor”) and are subject to change at any time. They are based on our proprietary research and general knowledge of said topic. The below content and applicable data are in support of our views on said topic. Please see additional disclosures at the end of this publication.

INTRODUCTION

It is no secret that Anchor believes the market is shifting from a period of outperformance by growth stocks to a period of outperformance by value stocks. That conviction stems from the presence of several conditions that are either currently present or are expected to manifest in the coming years, whichtypically spur value cycles. These drivers include elevated inflation, rising interest rates, the end of easy money, and higher economic growth.[1] We believe many growth stocks are priced for unrealistic expectations and will lag as those companies underperform their lofty expectations. We think the opposite is true for many value stocks whose valuations do not reflect improving growth prospects driven by the potential for a new capital investment cycle following a long period of underinvestment.

INTRODUCTION THE CASE FOR AN UPCOMING CAPEX SUPERCYCKE

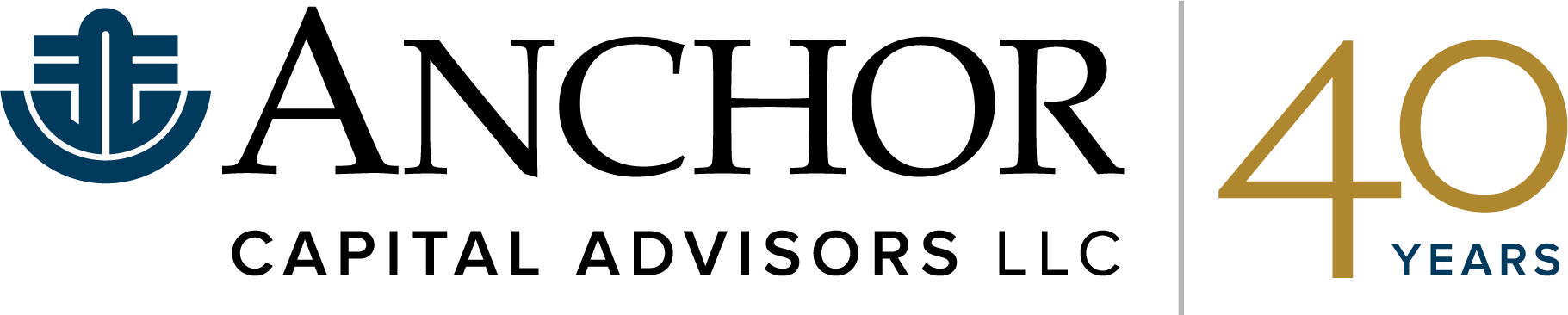

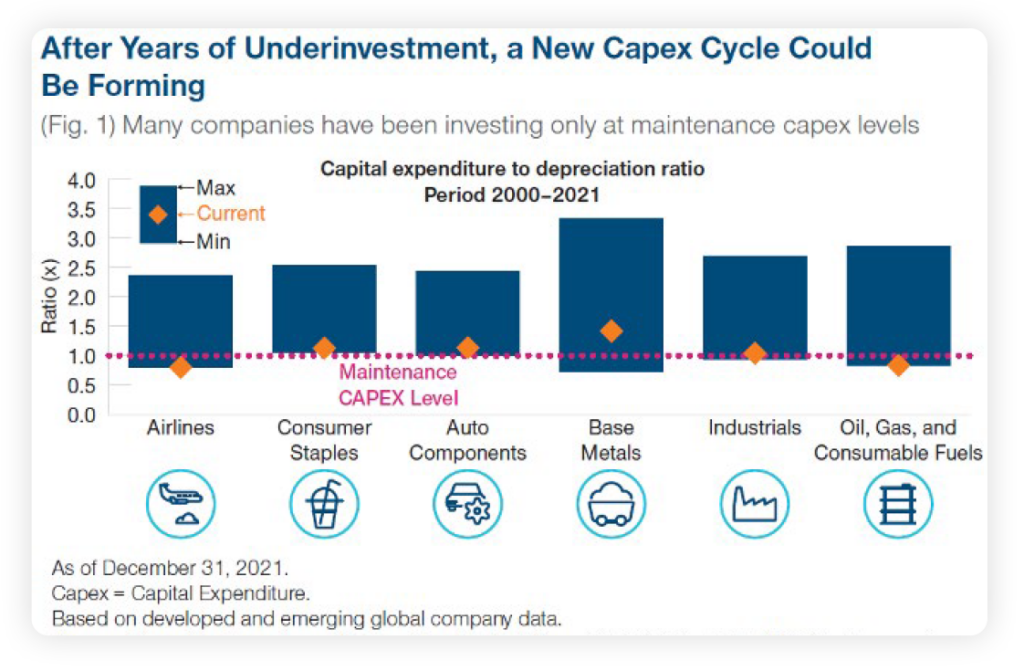

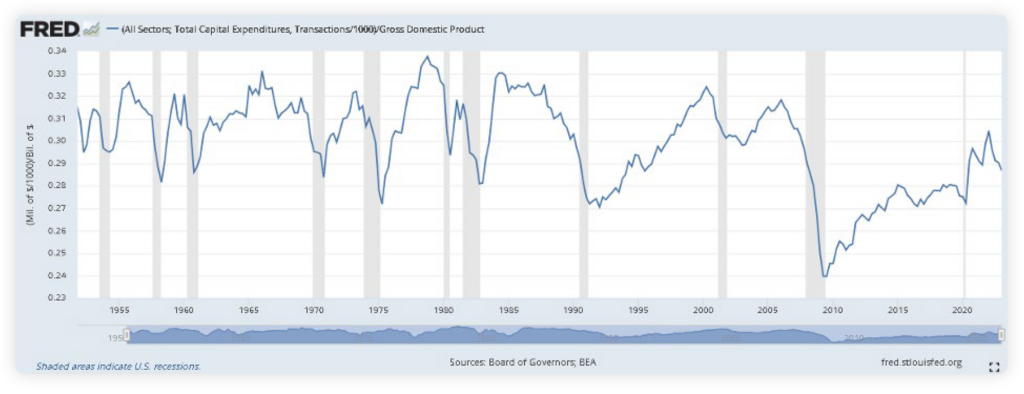

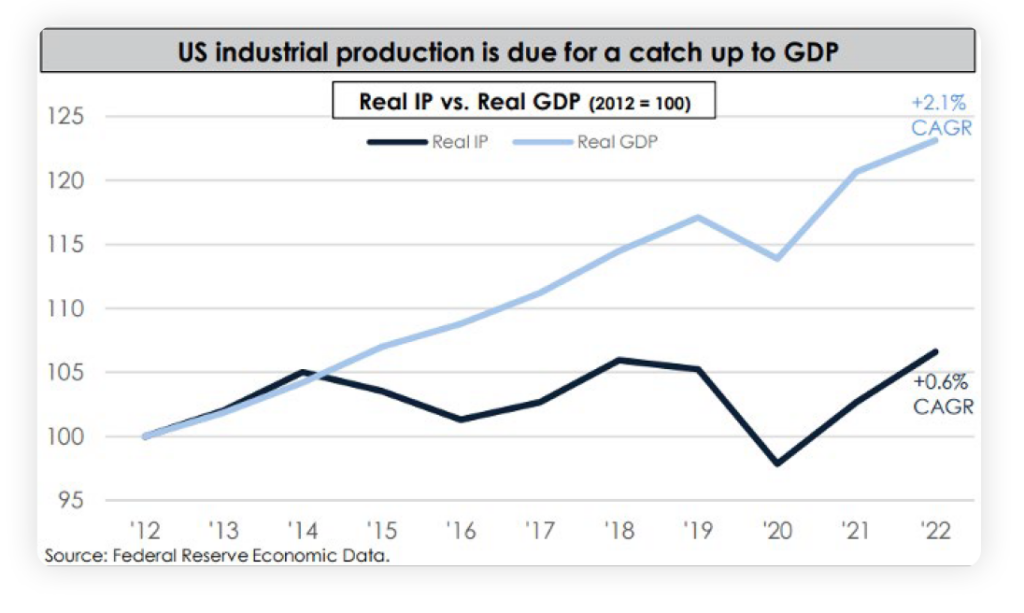

The negative demand shock brought on by the Global Financial Crisis (GFC) from 2007-2009 left many industries and companies decimated following a capital investment boom in the previous decades. As a result, following the GFC, the U.S. endured a lost decade of capital investment. This period experienced a boom in spending on intellectual property, but severe underinvestment in hard fixed assets by both corporations and governments.[2] Rather than investing to expand or improve productivity, many industries only invested at “maintenace capex” levels to sustain current operations.2 There are many ways to see this in the data. Between 1950 and 2007, capex as a % of GDP in the U.S. averaged north of 30%. That number fell below 25% during the GFC and stayed below 28% for all of the last decade until recently.[3] In fact, U.S. industrial production undergrew GDP by nearly 20 percentage points on a cumulative basis over the last decade.[4] In short, fixed asset spending has been below the long-term average for many years and at levels usually only seen in recessions.

Source: https://www.troweprice.com/financial-intermediary/uk/en/thinking/articles/2022/q3/how-value-can-benefit-from-a-new-investment-cycle.html

We believe there has been a changing of the guard, however, and that many companies and industries are now long overdue for a catch up in investment. Fortunately, we don’t think investors need to speculate what will drive this catchup as companies and governments have detailed it for us and in some areas it is already underway. Just in the last few years, the U.S. government passed over $1 trillion in total spend supporting infrastructure upgrades and efficiency, among other things.[5] Additionally, since January 2021, individual companies have announced nearly $600 billion worth of mega projects in the U.S. and Canada, which is 3x the normal run rate.[6] Below, we have identified several reasons why a capex supercycle is likely just beginning.

Source: https://fred.stlouisfed.org/graph/?g=qV4W

Source: Soroban Capital Partners, “Presentation to the UNP Board of Directors”

Source: Soroban Capital Partners, “Presentation to the UNP Board of Directors”

INTRODUCTION MEGA THEMES DRIVING INCREASED CAPITAL EXPENDITURE

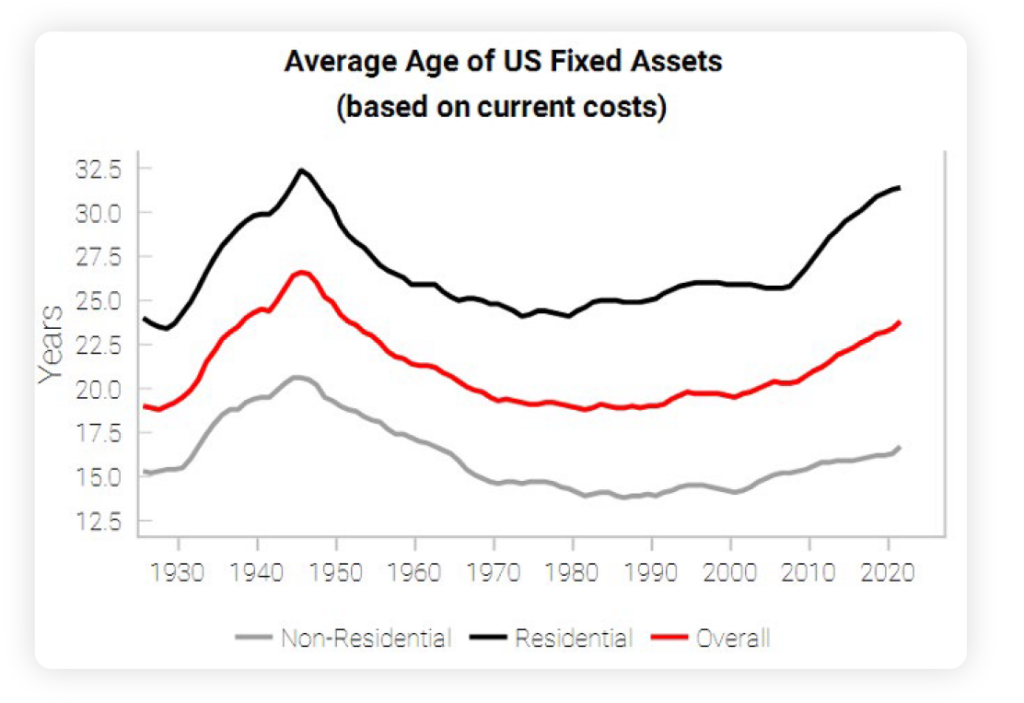

- Old Fixed Asset Base: The United States has a vast and diverse infrastructure system that has been developed over many years. Many of these physical assets were constructed decades ago with the average age of fixed assets at 60+ year highs.[7]

Source: https://blog.variantperception.com/p/the-age-of-scarcity-part-3-the-capex

The aging of these assets, such as the U.S. electrical grid, poses challenges in terms of meeting the demands of a growing population and evolving technology.[8] Sectors like manufacturing, healthcare, and agriculture could also benefit significantly from capital expenditures to upgrade outdated machinery and implement automation and robotics to enhance production processes and improve efficiency. We would note that the last time the U.S. fixed asset base was this old was just after World War II, which preceded a huge boom in capex. [7]

- Deglobalization / Reshoring: Following the supply chain disruptions of the last few years as well as heightened geopolitical tensions such as those seen between the US and China, countless companies are now rethinking how they construct and operate their supply chains. Many in the U.S. are making the decision to reshore to secure supply chain independence and protect intellectual property. This involves bringing back manufacturing and other business operations to the United States that were previously outsourced to other countries and requires significant investment to do so. In 2022, Kearney’s reshoring index was at its 2nd highest level ever and highest level since 2019, the year after the US/China trade war tensions initially began.[9]

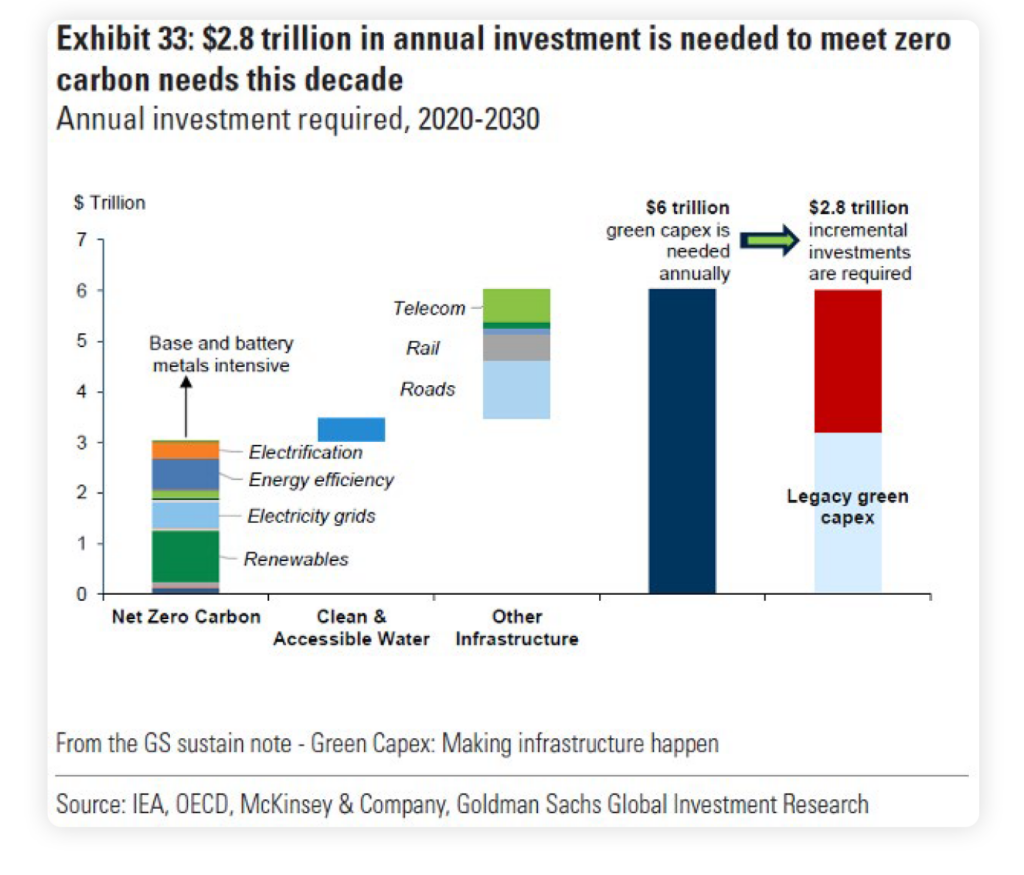

Source: https://www.goldmansachs.com/intelligence/pages/2023-commodity-outlook-an-underinvested-supercycle.html

- Energy Transition: The global shift towards renewable energy sources and sustainability appears to be prompting investments in clean energy infrastructure. Specific examples include renewable energy projects, such as solar and wind farms, battery storage facilities, and electric vehicle charging stations. These initiatives require substantial capital investments as individual companies and countries around the world try to achieve the ambitious carbon reduction targets they have set out. Goldman Sachs estimates that $2.8 trillion in annual investment is needed to meet zero carbon needs this decade. [10]

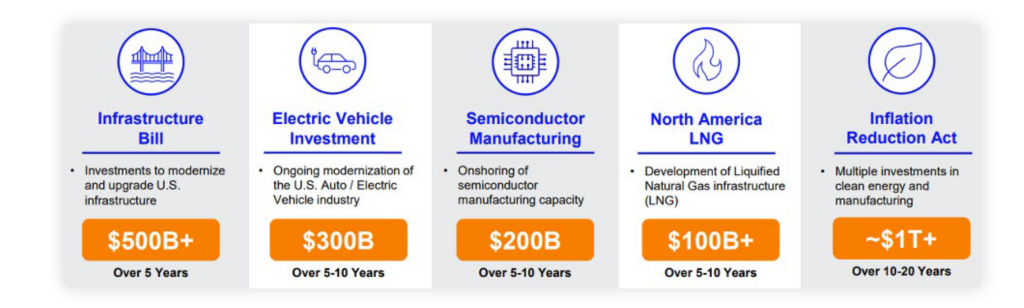

- Fiscal Spending: Last, but not least, the United States has recognized the urgent need for infrastructure improvements and has embarked on a significant investment push over the last several years. In total, the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the CHIPS and Science Act support over a trillion in investment across transportation, power grids, clean energy, electrification, EV and semiconductor manufacturing, broadband, and other infrastructure.[11] We believe this rebuilding and modernizing of infrastructure will be a major driver of the potential capex supercycle.

*Source: United Rentals 2023 Investor Day Presentation

INTRODUCTION WHY VALUE BENEFITS FROM A CAPITAL INVESTMENT CYCLE

The winners of the upcoming capital spending supercycle are likely to be different from the companies who have driven strong performance of the market in the previous decade. With ~$2 trillion of ongoing investments geared toward them, we believe this should provide demand tailwinds across the broader industrial, material, and utility complexes.[12] Given this, Anchor is invested in companies within the machinery, engineering, distribution, electrical, HVAC, EV, renewables, metals, broadband, transportation, and power grid spaces, among others. Not only do we expect growth rates to rise at these companies, but we also expect many of them to prove less cyclical due to the structural tailwinds described. These forces should combine to deliver outperformance in the coming years as new leaders emerge in the market.

CONCLUSION

In summary, with the aforementioned sectors combining to make up a large part of the value investment universe, we think this bodes well for value.[13] Further, not only are the value indices overweighted in these sectors vs. the growth indices, but nearly all of Anchor strategies are overweighted in these areas relative to their respective value indices. As the business cycle pendulum swings back towards the old economy, we hope this paper illustrates why we believe Anchor is well positioned to benefit from it.