Executive Summary

- We view mid cap stocks as a distinct segment of the U.S. equity landscape and believe there are key attributes that separate them from their small and large cap brethren. The mid cap universe is large and diverse; making up 22% of US securities listed on stock exchanges,1

- Mid cap companies can be growing yet established – combining the growth opportunities of smaller firms with the financial stability of larger businesses

- Mid cap has been under allocated and is often overlooked by investors and Wall Street analysts2

- The mid cap universe has historically provided both positive and consistent returns– outperforming both large and small cap stocks3

- Mid cap offers a favorable risk-reward relationship (as measured by Sharpe Ratio4) compared to all other market capitalizations5

At Anchor, we have a thirty-year plus history of thoroughly researching and investing in mid cap stocks. While there is no universally accepted definition of mid cap, we currently define the asset class as U.S. publicly traded companies with a market capitalization between $2 billion and $20 billion. By comparison, the Russell Mid Cap Index, which tracks 8006 companies as a baseline for performance, has holdings with market capitalizations ranging from $1.7 billion to $37 billion.7

Through our experience, we have witnessed first-hand some of the benefits that an allocation to mid cap stocks can make to a diversified portfolio, which we will discuss. We believe mid cap stocks are in the sweet spot between small and large cap stocks and offer a number of potential benefits when compared to securities of different capitalizations and styles. In our opinion, these include:

Large and Diverse Universe

In the U.S. there are over 6,822 listed securities8 on stock exchanges, which provide a wide breadth of companies to research and include in portfolios. A segment of the stock market that we feel to be overlooked while constructing portfolios is mid cap stocks. Currently, there are 1,497, or 22% of publicly listed companies9 that fit the above listed description of mid cap, and the representative Russell Mid Cap Index tracks 80010 of those companies as a baseline for performance.

Using the Global Industry Classification Standard (GICS), publicly traded companies are categorized into 11 universally excepted industry sectors: Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Healthcare, Industrials, Information Technology, Materials, Real Estate, and Utilities.11

These categories capture both the breadth and depth of global investible opportunities. A number of mid cap companies can be found within each of the listed GICS categories, with individual sector weightings ranging from 2.5% to 18.5%,12 clearly illustrating that the mid cap category is both large (1,497 listed securities) and diverse (securities in all GICS Industry Sectors).

Growing, But Stable

For large cap companies, according to the law of large numbers,13 there is a challenge to maintain a high growth rate. As the rate of growth slows company management’s focus then typically shifts to new avenues for growth, improving profitability and returning excess cash to shareholders. On the opposite end of the spectrum, small cap companies are usually in emerging areas or niche industries where growth can be much higher but also more unpredictable, as many small cap companies tend to be in the pre-earnings stage. For small cap companies, we believe there is also much less emphasis on returning cash to shareholders. Mid cap companies can fill the spot in between, where growth is still accelerating, earnings are stable and predictable, and the companies are established in their respective markets – they can often be growing yet established. For perspective, the average 10 year historical sales growth has been 7.3% for the S&P 500, 9.9% for the Russell Mid Cap Index and 16.8% for the Russell 2000 Index (small cap).14 Mid cap companies tend to be mature enough to have strong brands, professional management teams and we believe years of continued growth ahead of them.

Company Management

In our opinion, management is critically important to the success of any company. With mid cap companies senior executives may have significant ownership, which can more closely align their actions with shareholder interests.

As long-term investors, it is vital for us to build a relationship and trust with the leadership of a business. With a smaller shareholder base, we find mid cap management teams are willing to meet with investors allowing us to evaluate the company’s outlook, opportunities, challenges, and prospects.

Underrepresented in Indices, ETFs and Investor Portfolios

Most broad market indices and ETFs are market capitalization weighted – meaning individual components are weighted according to their total market capitalization.15 More specifically, the larger capitalized components carry higher percentage weighting; while the smaller capitalized components have lower weights. As a result, large companies have higher weights in broad market indices and ETFs than small and mid-sized companies do. In our opinion, because mid cap companies are not as prevalent in broad market indices or ETFs mid cap stock prices are less effected by passive buying and selling activity. With less passive noise, we believe clearer fundamentally based investment opportunities could exist in the mid cap segment of the market.

We have also found that the average investor has a smaller allocation to mid cap, at 13%, than is found in the universe of U.S securities listed on stock exchanges, 22%, and within broad market-weighted indices, 19%.16 In our opinion, the average investor is underweighting mid caps, because they feel they can adequately cover the asset class through the fringes of investments into large and small caps or the mid cap names are less well known than their large cap counterparts are. In both instances, we feel the relative underweight in mid caps presents an opportunity to find strong, well-run, underinvested businesses at potentially attractive valuations.

Underfollowed by the Street

We believe opportunity exists for fundamental investors if they are able to identify companies that are not broadly covered by sell-side analysts where in-depth research can help unearth prospects or issues that might be ignored by the broader market. The mid cap sector remains inefficient and under researched relative to the large cap universe because mid cap companies tend to have a minimal number of Wall Street analysts following the stock. The average number of analyst coverage for mid cap securities ($2-20B capitalization) within the Russell Mid Cap Index is 15. Where, by comparison, the average number of analyst coverage of large cap securities (>$20B capitalization) within the S&P 500 is 25.17 For those stocks in the Russell Mid Cap index, analyst coverage ranges from 0 to 39 as compared to 9 to 53 for the large caps in the S&P 500.18 We believe the true value is finding industry-leading companies that are overlooked because of size and lack of research coverage. In our opinion, having less, and in some cases no analyst coverage presents greater opportunity to exploit inefficiencies within the asset class.

Performance

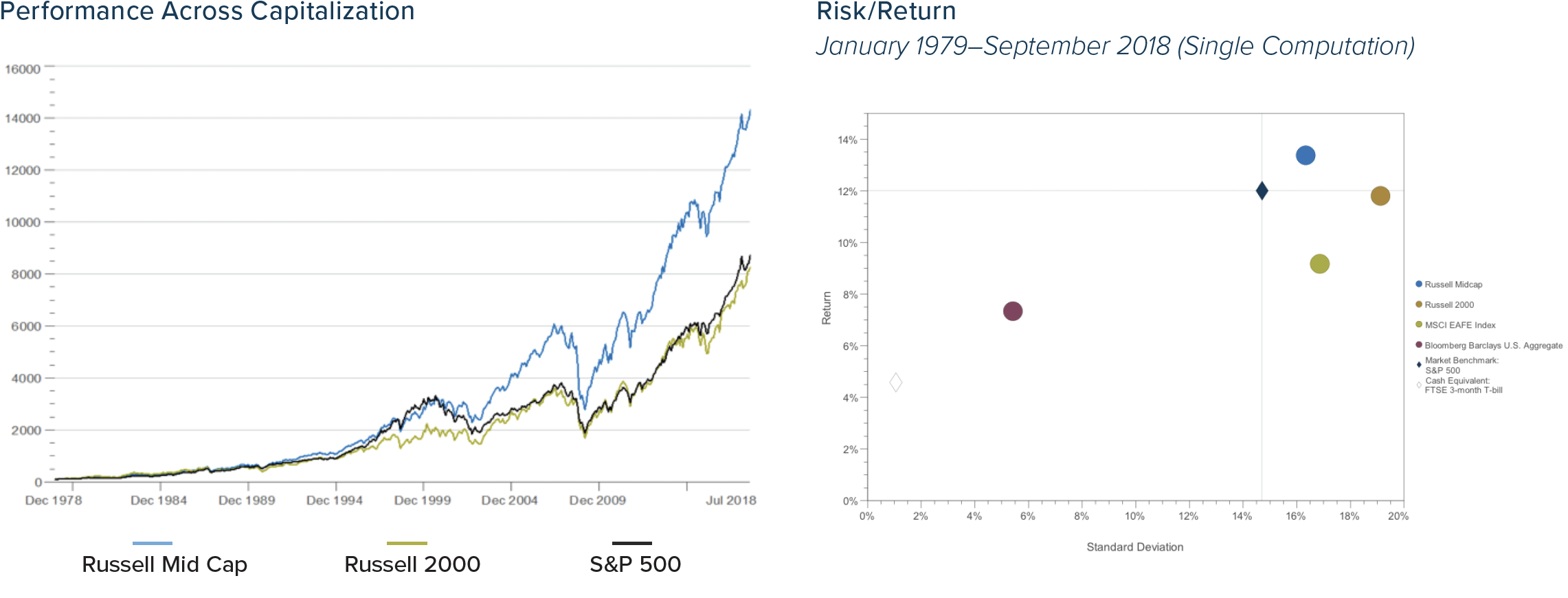

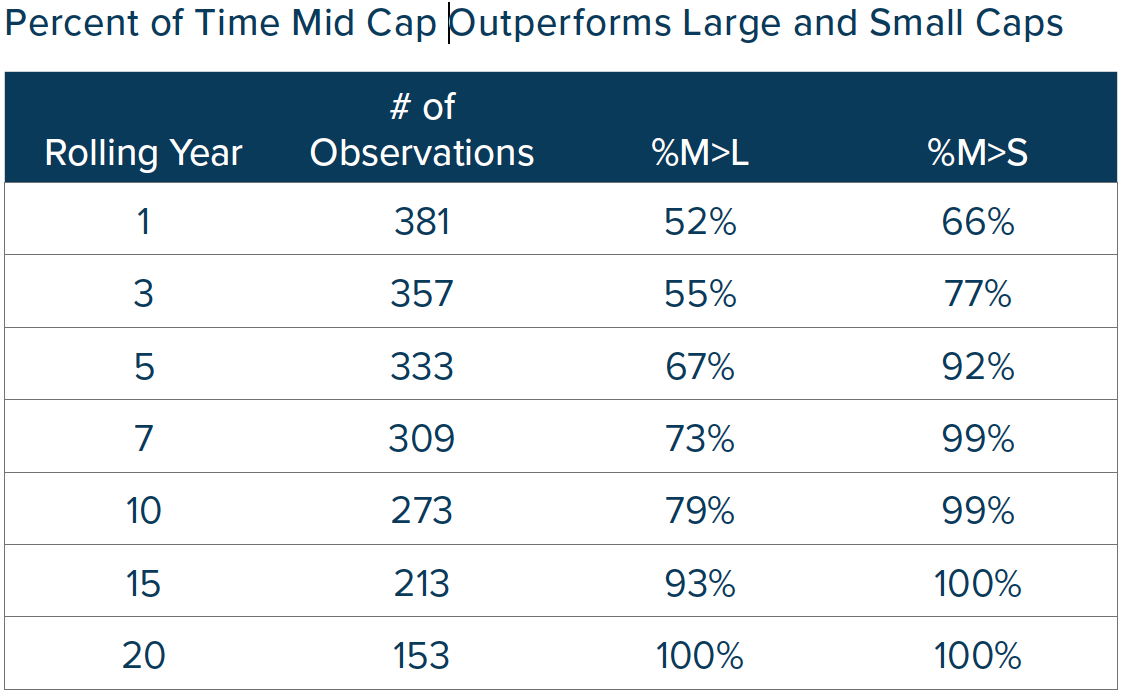

Over the past 40 years,19 which represents the largest mid cap data set we have access to at the time of this publication, mid cap stocks have significantly outperformed both large and small caps. In fact, an investment in mid caps has outperformed large and small caps in a majority of all rolling year periods since 1979. When looking at monthly rolling ten year returns, mid cap has provided better returns than large cap 79% of the time and better returns than small cap 99% of the time.20

The following graphic illustrates how the Russell Mid Cap Index has outperformed both the Russell 2000 and the S&P 500 Indices over a 40-year period.21

Consistent Returns Create a Favorable Long Term Risk-Return Relationship

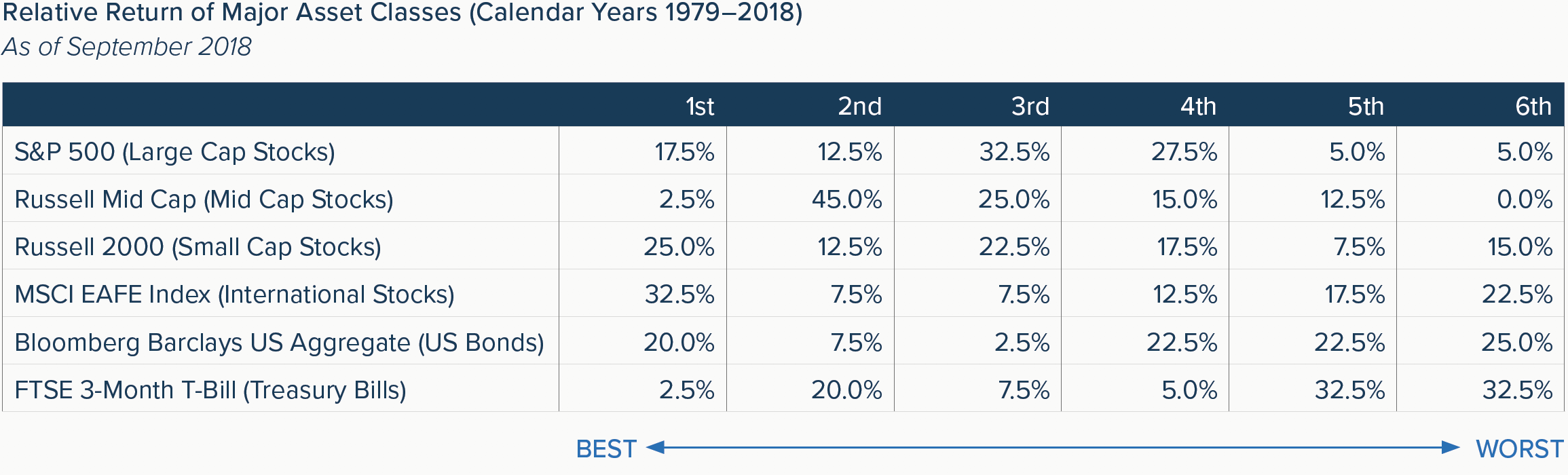

What is more interesting is the consistent performance mid caps have displayed. If you rank the calendar year performances of traditional asset classes from 1979 to 2018 mid cap was the top performer in only 2.5% of calendar years, while never being the worst performer.22 In 85.0% of calendar years during that time period mid cap was the second, third, or fourth best performer and the second or third best in 70.0% of observations.23 Yet during this time period mid caps delivered the best absolute performance relative to the other listed traditional asset classes.24

The consistency of mid cap returns has led to lower volatility and less risk (as measured by standard deviation) than small caps and, over long periods of time, risk levels closer to that of large cap. Over the past 40 years mid cap displays a favorable risk-return relationship when compared to both large and small caps. The same favorable risk-return relationship holds when looking at 20 and 30 year time periods as well.25

Higher Long Term Risk-Adjusted Returns

The consistency of mid caps performance is also illustrated through the analysis of long term Sharpe Ratios. A Sharpe Ratio is the measure of excess return per unit of risk, or the risk-adjusted return. Mid caps have provided a favorable Sharpe Ratio relative to both small and large cap overtime. Over the past 40 years mid cap has a Sharpe Ratio of .54 versus large cap of .50 and small cap of .38 over the same time period.26 Mid cap has a record of outperformance relative to the other asset classes on both an absolute and a risk-adjusted basis.27

Corporate Action

We find large cap companies will look to acquisitions as an avenue for growth. It is important that acquisitions result in higher growth or improved profitability. As a result, mid cap companies may become attractive acquisition candidates for large cap companies. Over the last five years, we have seen over 196 acquisitions of companies with a market capitalization between $2 billion and $20 billion, which is over 20% of all the acquisitions of publicly traded companies.28

We routinely see large cap companies spin-off divisions or businesses into a new publicly traded company. Generally, there is limited information about the spun-off company, which we view as an opportunity, through our research, to add value in portfolios. Over the last five years 42 of the 166 spin-offs, or 25% of all spin-offs, have emerged as mid cap.29

Current Conditions

The unwinding of quantitative measures by the U. S. Federal Reserve has contributed to a strengthening U.S. dollar. A stronger U.S. dollar potentially creates a headwind for large cap companies. With fewer of their business activities internationally, small and mid cap companies are not as impacted by foreign exchange issues. 43% of the revenue for S&P 500 companies is generated outside of the U.S., while only 26% of revenue for Russell Mid Cap companies and 18% of revenue for Russell 2000 companies.30

With a greater domestic focus, mid cap companies benefit from the recent change in U.S. corporate tax rates. Companies that have more revenue generating activities in the U.S. moved from a maximum corporate tax rate of 35% to a new tax rate of approximately 21%.31 As a result, some companies have additional cash flow, which has been used to reinvest in the business, spend on capital expenditures, and distribute to shareholders via share repurchases or dividends.32

Our View

We feel mid cap stocks play an important role in a client’s asset allocation as they may provide the distinctive characteristics mentioned above relative to other segments of U.S. equities. Positive absolute performance coupled with a favorable risk-return relationship contributes to higher long term risk-adjusted returns relative to large and small caps. The performance combined with mid caps being both under allocated and underfollowed tells us that opportunity exists to exploit potential inefficiencies within a large and diverse segment of the market. Investors would be well served to consider an allocation to mid caps as part of a diversified portfolio.

Our long time horizon and focus on valuation allows us to be patient investors as we watch these companies, which we trust will grow and move into larger market capitalizations. We continue to believe that the characteristics for mid cap stocks will be favorable and will add value to client portfolios.

Click here to download a PDF of this article.