The views expressed are those of Anchor Capital Advisors, LLC (“Anchor”) and are subject to change at any time. They are based on our proprietary research and general knowledge of said topic. The content and applicable data are in support of our views on said topic. Please see additional disclosures at the end of this publication.

Introduction

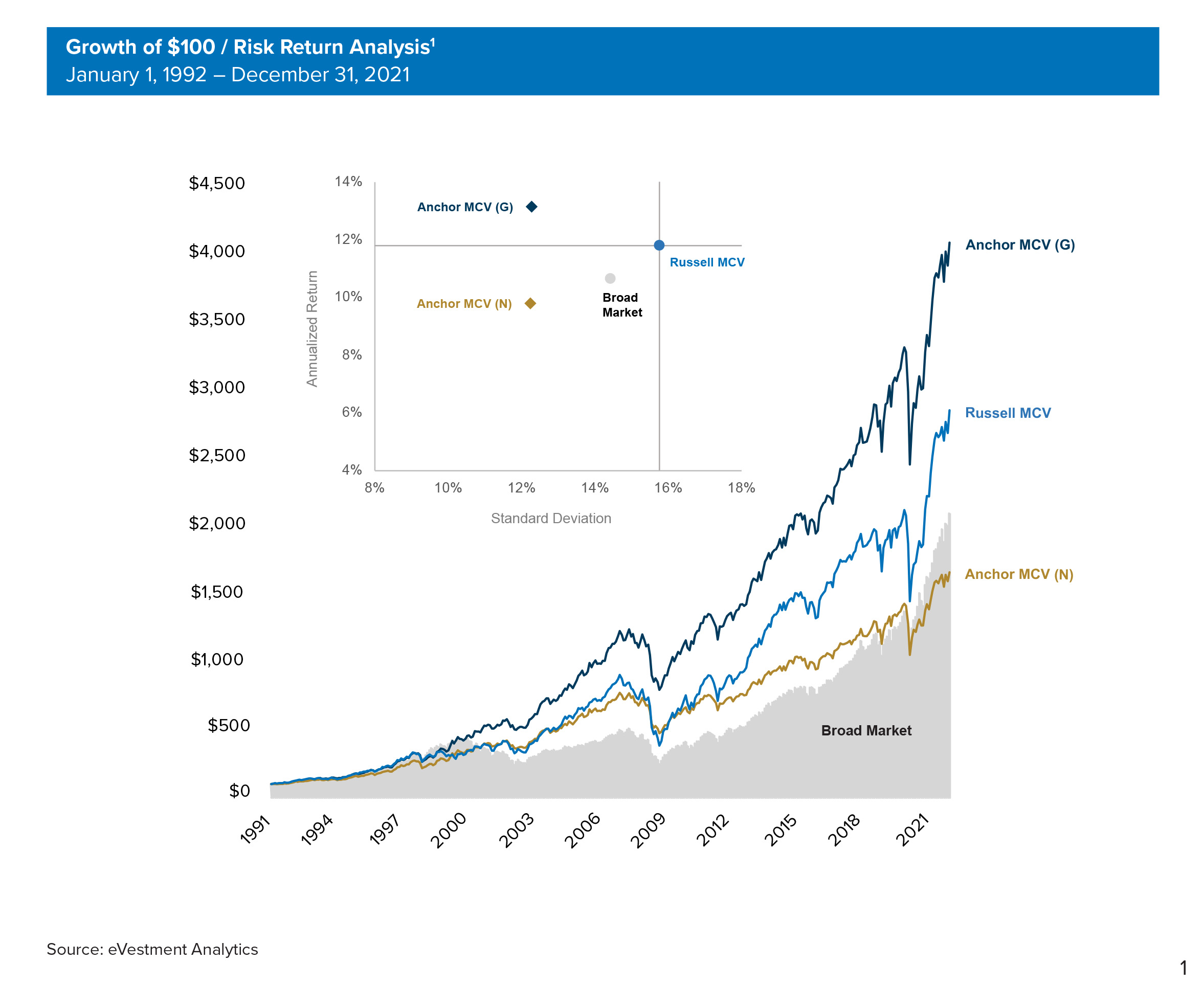

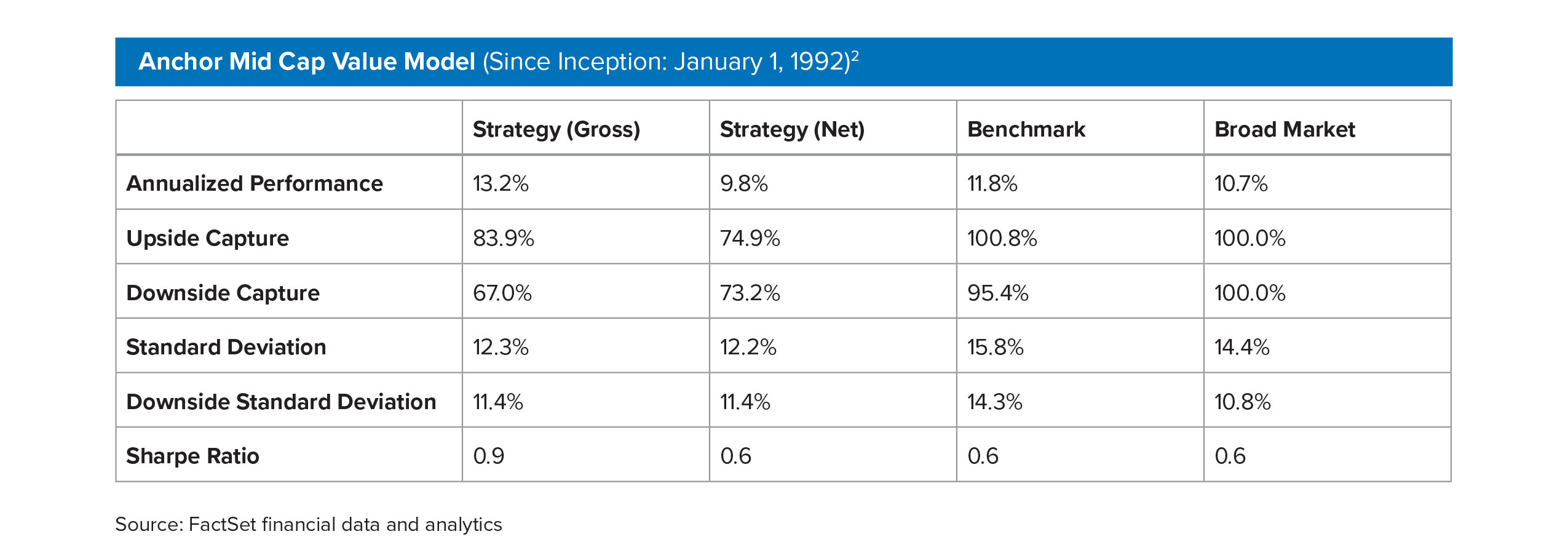

Anchor Capital has held a singular mission since its founding in 1983; to protect and grow the capital to which we have been entrusted over the long-term, by maintaining a disciplined, repeatable investment process tied to an unwavering risk management process. To that end, we employ our fundamental investment approach to discover, what we consider to be, high quality companies, generating stable, consistent returns while protecting and preserving wealth in turbulent markets. Our unwavering commitment to both capital appreciation and capital preservation have been factors that have allowed us the opportunity to compound shareholder wealth at what we believe to be a much greater rate than the market, while providing relative downside protection. This is the hallmark of Anchor’s DNA.

Long term Compounding – Key Investment Tenets

We focus on the fundamentals. With the belief that the key to securing compounded growth over the long-term lies in constructing a portfolio of companies that we believe to be high quality, well run and that are undervalued relative to the broader market. The following elements of our investment process are critical to attaining the results in the chart above:

- Margin of Safety/Valuation

Anchor seeks to buy companies that are trading at a discount to our assessment of their intrinsic value, which we refer to as a margin of safety. Intrinsic value may be determined by the company’s ability to generate free cash flow over time or by the value of the company’s assets. Valuation methods include discounted cash flow analysis, calculation of the net asset value of the company, an assessment of the company’s private market value based on recent deal activity, sum-of-the-parts analysis, a consideration of earnings power based on normalized margins (especially for highly cyclical businesses or companies with transitory issues).

We attempt to identify sources of a company’s tangible value, which may include brands or trademarks, land or real estate, fixed assets or contracts and goodwill. Anchor will use as many valuation tools as possible or appropriate for each situation. A portfolio of undervalued companies at the time of purchase should help to preserve capital over time. Much of our success can be attributed to our ability to protect our clients’ assets in turbulent market environments.

- Risk Assessment

Riskier investments are those for which the outcome is less certain and for which the probability distribution of returns is wider. Risks that we rigorously assess include technology obsolescence, patent expiration, management turnover, data security, competition, environmental regulations, capital allocation, balance sheet, interest rate, foreign exchange rate, and accounting risks. Anchor defines risk as the permanent loss of principal.

- Time Horizon

Anchor has a 3-5 year time horizon for investments and in many instances, can be even longer. We practice what we call “time horizon arbitrage”, which means that by having a longer time horizon than other investors, we can afford to look past a company’s short term difficulties to a potential time when the share price will more closely approximate our estimate of intrinsic value. This is one of our key differentiators.

- Key Sustainable Advantages: Companies with Significant Moat

Having a sustainable competitive advantage is a critical component of growth, and the accretion and compounding of net asset value. We invest in companies that consistently generate returns on capital significantly in excess of their cost of capital. We seek companies with strong franchises, large amounts of predictable and recurring revenues, high barriers to entry, hard to replace assets, leading market positions, strong brands and the ability to raise prices.

- Quality of Business Model

Anchor considers the quality of the business, stressing the visibility of sales and earnings, the consistency of the company’s operating history, the degree to which the company is integral to the functioning of its customers, the amount of recurring revenue and the competitive environment. We appraise the value of the company’s physical and intangible assets. We prefer businesses that are easy to understand, analyze, model, and that are dominant in their industry. A good business should be able to raise prices at least enough to offset inflationary pressures.

- Industry Structure and Competitive Dynamics

Anchor seeks to understand the characteristics of the industry in which a company operates and takes into consideration the bargaining power of suppliers and buyers and the threat of new entrants and substitution. The underlying growth trends and competition within the industry and among other industries are important considerations. We should be able to reasonably estimate what the industry will look like five years from now.

- Avoidance of Leverage

We pay close attention to a company’s financial leverage and avoid companies that we believe have too much debt or other obligations. We have a strong preference for companies that are less dependent on the capital markets for their financing and are better able to make capital allocation decisions. Importantly, we also consider operating leverage, which is a measure of the impact on a company’s earnings that could result from a decline in sales. We also consider a company’s concentration in a particular industry, geography, or exposure to a large customer.

- Analyzing a Company’s Earnings

In addition to GAAP earnings, Anchor considers a company’s “look through earnings”. We define these as the operating cash flow of the company less capital expenditures, adjusted for share based compensation dilution (we assume that share based dilution will be offset with cash flow that would otherwise be available to shareholders or reinvested in the business) and adjusted for other cash requirements such as pension contributions. We want to know what cash flow shareholders can truly consider “theirs”. The predictability, sustainability, and estimated growth of look through earnings are critical.

- Analyzing Management

Anchor speaks and/or meets with the management teams of its holdings on a regular basis and evaluates them based on their honesty, their historic record of achieving specific goals, their ability to communicate a concise capital allocation framework and our assessment of the alignment of their incentives with the interests of our clients. It is important that management have a significant portion of their net worth in the shares of the company. Analysts often conduct company and facility visits as part of their work. We view our ownership of companies’ shares as a long-term partnership between management and us and act as fiduciaries on behalf of our clients.

- Growth Prospects

While Anchor is a value manager, we seek companies that are growing their sales, cash flow, and intrinsic value per share. We believe that growth can be hard to predict, and we are generally not willing to pay high multiples for companies that are considered to be rapid growers, however, we often consider buying faster growing companies when their valuations are attractive.

- Adequate Return

An adequate return is dependent upon several factors, but at a minimum Anchor looks for companies that will grow earnings faster than the market and in many cases pay a dividend to shareholders. Anchor requires a minimum 10% expected total return annually for equity purchases.

We believe the critical tenets to achieving long-term compounded returns are the ability to provide not only competitive results in appreciating markets, but also protecting capital when markets are in decline. Demonstrated in the grid above, Anchor’s long-term outperformance has been achieved primarily by capital preservation. We have been competitive with market returns on the upside, but our outperformance on the downside has been the foundation for our long-term performance.

To download this article, click here.