The views expressed below are those of Anchor Capital Advisors, LLC (“Anchor”) as of the date written on the last page of disclosures and are subject to change at any time. They are based on our proprietary research and general knowledge of said topic. The below content and applicable data are in support of our views on said topic. Please see additional disclosures at the end of this publication.

One of the most popular topics in investing today is ESG, or environmental, social, governance. ESG is a catchall for a variety of topics that are important to investors, but it does not fit neatly into the realm of financial data. The ESG topics that matter to one investor may be completely different from what matters for another investor. Furthermore, does the focus and attention that a financial investor has on ESG have a material impact on the financial results and the stock prices of companies? We believe so, and we review the topics relevant to a particular industry as part of our investment process.

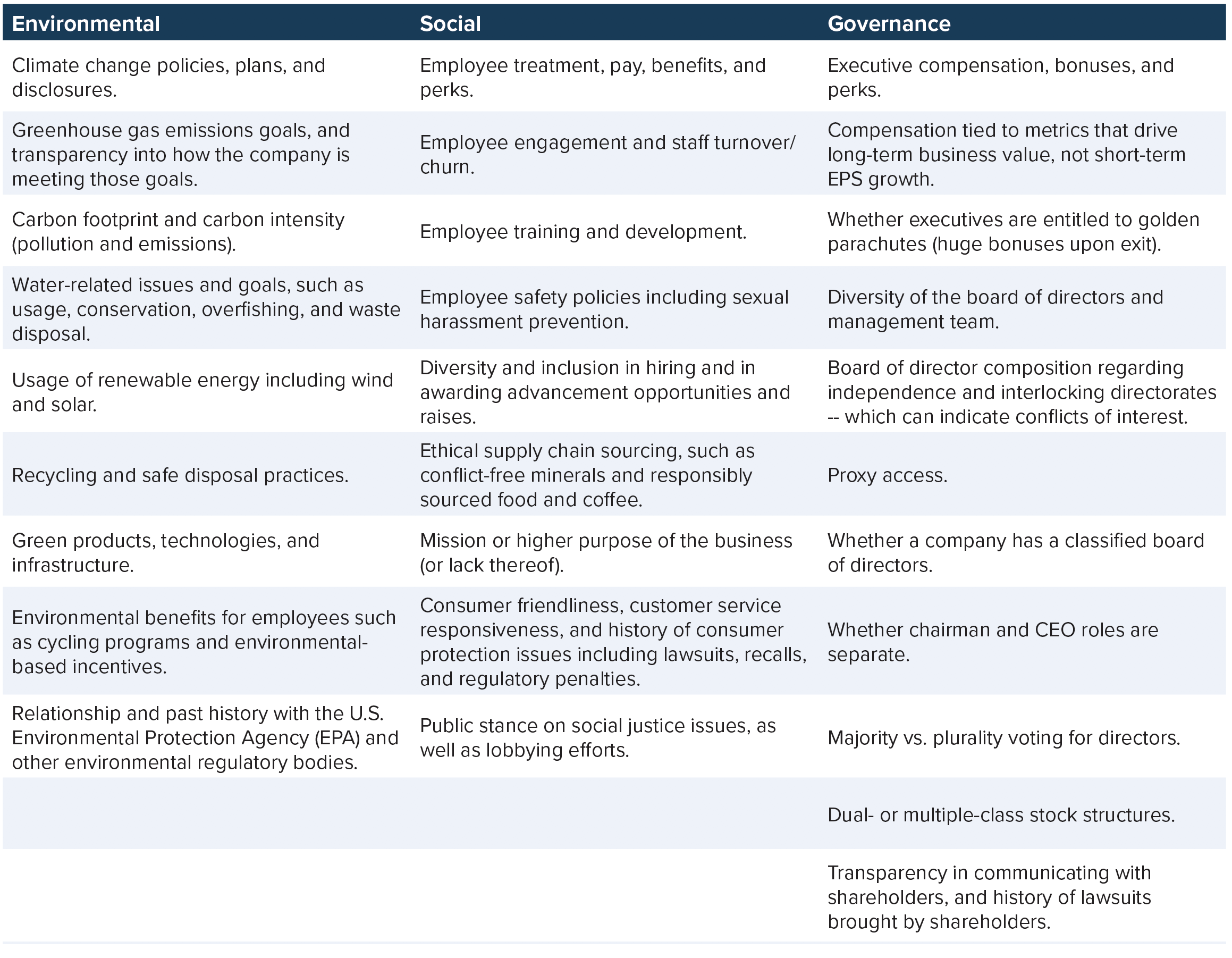

Examples of the topics that fall under ESG

A Brief History of ESG

The roots of ESG began when pension funds and unions started investing in things like housing projects and healthcare in the 1950s1 ; this was referred to as socially responsible investing (SRI). Many pension funds and charitable organizations would ask their investment managers to negative screen for certain types of companies like tobacco, alcohol, firearms.2 In the 1970s, SRI came into the limelight when U.S. businesses divested from South African companies to protest Apartheid.3 However, the real push started in the 1990s when social and environmental organizations started working together towards overall responsible investments (beginning of ESG). By 1998, Robert Levering and Milton Moskowitz researched the Fortune 100 “Best Companies to Work For” and found that companies with better corporate social responsibility were more productive and efficient.4 With that, we saw a number of smaller firms establish teams to review companies for ESG criteria and to rank companies relative to each other. Over the years, MSCI5 bought a number of these data vendors; we believe it is now one of the largest ESG data depositories, along with another firm called Sustainalytics.

Along with having access to data sources and many European pension plans increasingly focused on the issues, ESG momentum started to build.6 In 2006, the United Nations established Principles for Responsible Investing (PRI) and asked that investment firms establish a framework for including ESG principles as part of their investment process.7 Nowadays, many corporations file sustainability reports, including reporting on carbon emissions and water usage data; they also engage with investors on topics such as governance, workplace environment, and other environmental concerns.

Current Hot Topics in ESG

Over the last few months, as our investment team attended conferences and met with investors and clients, they found that four ESG topics are being widely discussed: carbon emissions and the Paris Agreement; plastics/recycling; income inequality and dispersion of corporate pay; and diversity of corporate boards.

-

Carbon Emissions and the Paris Agreement

The Paris Agreement is an effort to bring all nations together to combat global climate change.8 The central aim of the Agreement is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius, above pre-industrial levels, and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius.9 If nations around the world keep adding greenhouse gases at the current rate, it is believed that the average temperature around the world could increase 4 degrees to 12 degrees by 2100.10 The result could be heat waves, droughts, erratic weather including massive hurricanes and snowstorms, melting ice caps and increased ocean acidity.11 By focusing on reducing greenhouse gases and by utilizing renewable energy, the average temperature increase will be less.12 Last year carbon dioxide emissions increased 1.7% with China and U.S. contributing to the increase while emissions decreased in Europe.13 There is still a lot of work to be done. This topic relates to a number of industries, including oil and gas, utilities, housing, insurance, agriculture, tourism, and any business that could be affected by severe weather delays.

-

Plastics and Recycling

In the last year, there has been increased investor attention on the number of plastics and recycling of plastics. Plastics were originally developed in the 1950s using oil resins and other chemicals to produce the rigid but malleable product used in everything that we use day-to-day.14 Currently, it is estimated that 5.3 million to 14 million tons of plastics are thrown away each year; only 10% is recycled.15 Much of the plastics end up in waterways and never biodegrade.16 In fact, they break down into microplastics over decades and are being ingested by marine animals, including the fish we eat.17 For some time now, China has been the largest importer of recycling items such as plastics and paper.18 In 2018, China banned plastic recycling and many municipalities in the U.S. and Europe are finding it difficult to find a cost-effective place to send the recycling, which results in more plastic ending up in landfills or being burned causing air pollution.19 The impact affects a number of industries, such as health care, food supply, insurance, packaging and chemical companies, and companies that are in the process of trying to find cost-effective alternatives to plastic packaging and products.

-

Income Inequality and Dispersion of Corporate Pay

Globally two separate issues have risen this year bringing closer attention to income inequality and the dispersion of corporate pay. In France, the yellow vest movement started late last year in protest of rising fuel taxes, the high cost of living, and the disproportionate burden of the government’s tax reforms falling on the working and middle classes.20 Each week in France, protestors have been rioting, and it appears the movement may be spreading to other European countries.21 In many ways, some of these same concerns have been voiced in the U.S. Many people in the U.S. are being affected by higher education, housing, and health care costs. In April, Disney heiress, Abigail Disney, who is the granddaughter of Roy Disney, gave a searing attack on the “insane” compensation of Disney CEO, Bob Iger, relative to the pay at the bottom end of Disney’s payroll.22 There are concerns that the U.S. is losing its middle class and the broader implications of this loss on society. Impacts of this movement could include higher scrutiny on executive compensation relative to other employees, the role of corporations versus government in taking care of employees, higher minimum wages, and a focus on bringing down costs in health care, education and housing, especially for the middle class.

-

Diversity of Corporate Boards

Over the last few years more investors are focused on company and board governance. The particular topics of interest include separation of the Chairman and CEO titles, having a larger percentage of independent board members, and board member diversity. The concern, especially in cases where there has been mismanagement or fraud, has been that board members of similar backgrounds or of similar make-up lends itself more to group think. Furthermore, in the #MeToo era there has been a larger focus on women in senior management positions and board representation. California has enacted a law that requires all corporations headquartered in California to have one women board member by the end of 2019 and that the number of women board members must increase by 2021.23 It will be interesting to see if more states enact similar laws. We believe having a diverse board results in better governance and ultimately benefits shareholders.

Anchor and ESG Investing

Anchor is not a dedicated ESG manager, nor does it strictly exclude companies based on ESG criteria. We are focused on finding high quality companies that have strong management teams and strong overall governance practices that are trading at attractive valuations. We are also aware of environmental and social issues and how they affect the industries and companies we research. In our bottom-up assessment of companies, we review for these issues and determine the material impact that they can have on the strategic outlook as well as the financial impact. We believe that we look for both financial value and sustainable value.

Click here to download a PDF of this article.