The views expressed are those of Anchor Capital Advisors, LLC (“Anchor”) and are subject to change at any time. They are based on our proprietary research and general knowledge of said topic. The below content and applicable data are in support of our views on said topic. Please see additional disclosures at the end of this publication.

USING YOUR BALANCE SHEET AS A FINANCIAL ROADMAP

Always Have A Plan

After several years of robust growth and generally stable conditions, the current economic environment can be better characterized by heightened uncertainty caused by factors such as inflationary risks, market volatility, and legislative partisanship. This uncertainty increases the importance of holistic financial planning and risk mitigation for individuals.

According to a recent study [1], Americans who regularly engage in financial planning are more likely to feel financially stable, have an emergency fund, be better at managing their debt, and invest with a better understanding of their risk tolerance. Not only can the process help maintain healthier financial habits, but it also creates a roadmap to keep people “on track” towards their financial goals. The roadmap then acts as the foundational baseline should any goals change, or when market and legislative environments inevitably fluctuate. Despite all the benefits, only one-third of Americans have a financial plan, and a majority of that subset have only gone through the exercise once.

Having a financial plan that is dynamic and specifically tailored for an individual can help steer their financial life towards their goals and through uncertain waters.

It All Starts With the Balance Sheet

At Anchor Capital, we take a holistic balance sheet approach to wealth management. This top-down perspective allows us to ensure all parts of your financial life are working together, and that any changes are appropriately reflected throughout. Making well-informed decisions needs to consider both sides of your balance sheet (i.e., assets and liabilities), the specific makeup of those items, as well as your individual tax, estate planning, insurance, and cash flow profiles.

The balance sheet creation process is the critical first step in planning for your financial goals. All items within your financial life should be included, such as sizeable bank accounts, investment accounts, retirement assets, private investments, real estate, business interests, mortgages, life insurance policies, art & collectibles, etc. Our Document Request Checklist, can be a useful guide for gathering materials for your balance sheet.

The balance sheet creation process is the critical first step in planning for your financial goals. All items within your financial life should be included, such as sizeable bank accounts, investment accounts, retirement assets, private investments, real estate, business interests, mortgages, life insurance policies, art & collectibles, etc. Our Document Request Checklist, can be a useful guide for gathering materials for your balance sheet.

Clarity on your balance sheet will not only help establish a custom roadmap towards your financial goals, but it also allows us to identify potential areas of concern and prioritize the action items accordingly. These concerns can include items such as liquidity issues, lack of tax-diversification, and estate tax liability exposure.

Our holistic balance sheet approach can not only identify these risk exposures, but it can help create proactive measures to protect against these vulnerabilities and avoid potential financial setbacks. In the subsequent sections, we’ll dive deeper into these topics with examples.

UNDERSTANDING & ADDRESSING AN ESTATE TAX LIABILITY

Estate taxes are a unique part of the Tax Code as it applies to a relatively small percentage of the population, and yet its effects can call for significant planning and it can hold a great deal of importance in political discourse. While estate, gift, and generation-skipping transfer (“GST”) taxes are three distinct items, they are often considered together as they share the same tax rate and require similar planning techniques.

The federal estate tax is applied against the total value of an individual’s estate above and beyond their lifetime exemption amount. For 2023, that exemption amount is $12.92 MM per individual and set to increase to $13.61 MM in 2024. Due to this high threshold, only about 0.2% of estates are subject to the tax, according to the Congressional Budget Office. [2]

With that said, the tax is fairly adverse as it can be up to 40% of the taxable estate’s total value, and the exemption amount is frequently targeted by legislative proposals. Under current law, the exemption is set to decrease dramatically in 2026 to pre-2017 figures (i.e., $5.49 MM), adjusted for inflation. Because of this, a main driver of complex trust planning techniques is to mitigate the estate tax liability and maximize generational wealth transfer. Structures such as GRATs have been credited for avoiding as much $100 billion in estate taxes since 2000. [3]

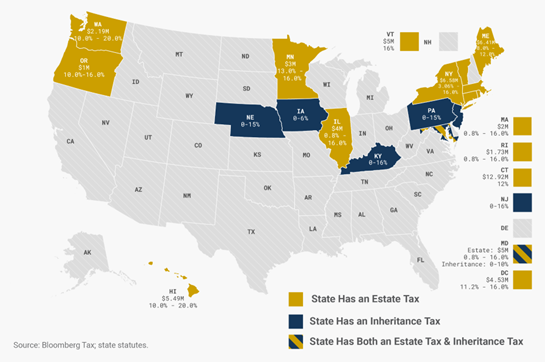

While these complex strategies are not appropriate for all, it is important to note that states can have their own estate tax using separate exemptions and rates. Currently, 17 states and the District of Columbia levy a separate estate or inheritance tax. These can carry exemption amounts as low as $1 MM with rates as high as 20%. This opens the door for a significantly larger population of individuals whose estates will be subject to tax. For reference, the below map [4] illustrates the states that have an estate or inheritance tax:

Utilizing a balance sheet approach is critical for effective estate tax mitigation planning. As estate taxes are applied against the total estate value, as opposed to most taxes which are applied against gains, knowing an individual’s full financial picture is necessary in understanding their exposure. Additionally, the balance sheet gives insight into the makeup of assets. This is an important driver in customizing the right planning strategy as it should always include individualized factors such as liquidity, tax profile, risk appetite, and investing time horizon. A well-designed estate plan can help promote a smooth transition of wealth to the next generation while protecting the heirs by minimizing the impact of estate taxes.

Example: The Real Estate Investor

Cyrus accumulated his family’s wealth through years of successful real estate investments. Through diligent planning along the way with his Anchor Team, he is comfortable with the liquidity on his balance sheet, as well as the debt levels across the various real estate entities. Now that his adult children are all working professionals and financially responsible, he feels comfortable with the idea of proactively addressing his potential estate tax liability via multi-generational gift planning.

Through analysis of Cyrus’ balance sheet, the Anchor Team can estimate his current estate tax exposure, noting it will increase significantly in 2026 when the lifetime exemption amounts are set to decrease. After further discussions with Cyrus’ attorney, they propose various action items to mitigate the future estate tax exposure.

To avoid a situation where Cyrus is left with a liquidity issue, they decide to transfer interest from the various real estate entities into newly established multi-generational trusts. The process, which is assisted by a valuation expert, is intended to both minimize Cyrus’ estate while also moving income-producing property into trusts for his children. Additionally, separate trusts are created for the sole purpose of owning life insurance policies on Cyrus. The strategy here is to provide his children with immediate liquidity at his passing in an estate tax free manner. The liquidity would not only counterbalance the illiquidity of the real estate-heavy inheritance, but it would also assist with any potential state estate tax liabilities.

While a potential estate tax liability is something that needs to be constantly addressed and revisited, Cyrus is comforted by the fact that these estate planning structures will serve to enhance his family’s financial stability and help with a smoother generational wealth transfer.

HOW ANCHOR CAN HELP

Every individual possesses a unique financial profile based on their goals, assets, income, and risk tolerance. A holistic balance sheet approach is an effective step in understanding your standing and pathway towards your financial goals. Contact your Private Client Advisor to review your individual situation further and design a strategic plan for you.

Download PDF Here, Understanding & Addressing an Estate Tax Liability

Click here to catch up on Part 1 of the series, Tax Diversification Across the Balance Sheet

Click here to catch up on Part 2 of the series, Mitigating Potential Illiquidity Risk

1Charles Schwab Modern Wealth Survey

3Bloomberg Estimate by Richard Covey

The views expressed are those of Anchor Capital Advisors, LLC (”Anchor”) as of the date written and are subject to change at any time. Anchor does not undertake any obligation to update the information contained herein as of any future date, nor does it have liability for decisions based on this information. Certain information (including any forward looking statements and economic and market information) has been obtained from sources we deem reliable, but is not guaranteed by Anchor, nor is it a complete summary of available data. This publication has been prepared by Anchor Capital Advisors, LLC (Anchor). The information is for educational purposes only and should not be considered investment advice or a recommendation of any particular strategy or investment product. These opinions are not intended to be a forecast of future events or a guarantee of future results. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Anchor. Past performance is not guarantee of future results. Inherent in any investment is the possibility of loss.