The views expressed are those of Anchor Capital Advisors, LLC (“Anchor”) and are subject to change at any time. They are based on our proprietary research and general knowledge of said topic. The below content and applicable data are in support of our views on said topic. Please see additional disclosures at the end of this publication.

Executive Summary:

- Dividends can be an important component of total return over the long-term, with dividend paying stocks having outperformed non-dividend paying stocks over the long-term.[1]

- Not all dividend paying stocks are the same. Investing in stocks with absolute high dividends may not be the best strategy.

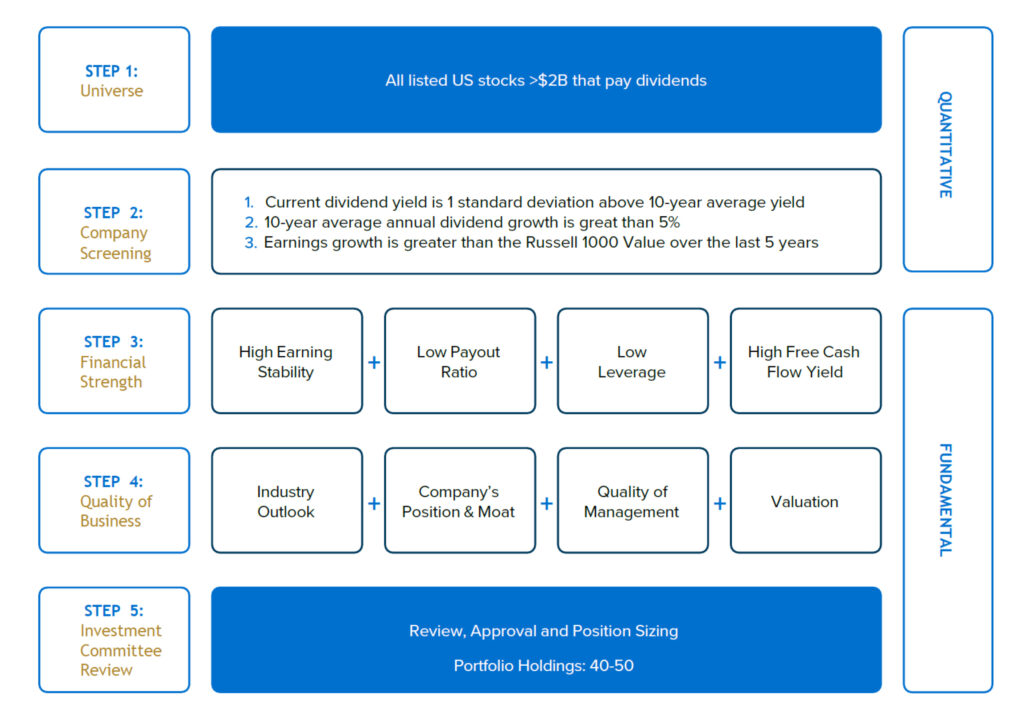

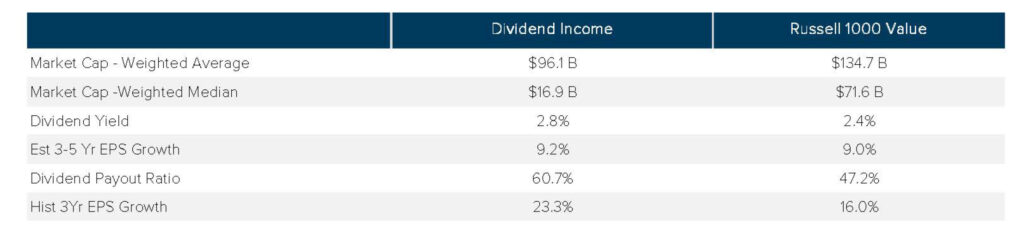

- Anchor’s equity income – all cap oriented, Dividend Income Value strategy focuses on current and growing income. Factors that differentiate Anchor’s Dividend Income Value strategy, high exposure to small and mid cap stocks, selects dividend paying stocks throughout sectors rather than solely focusing on the highest paying stocks which helps to mitigate risk.

While a major portion of an investor’s return can come from dividends, investing in stocks with absolute high dividends may not be the best strategy. The reason is two-fold: one, companies that grow dividends faster than their earnings tend to reach a point where the dividends are not sustained by earnings, and investors can see through this. Second, these companies may miss investments in growth opportunities in the quest to pay higher dividends.

However, at Anchor, we have observed that companies, which pay sustainable dividends, tend to outperform their benchmark over the long term. We believe dividend payments force companies to make more responsible financial decisions. We put a lot of emphasis on obtaining dividend income from companies that can afford to not only pay dividends but also grow them – at least in line with earnings growth. We also expect the companies in our portfolio to grow their earnings faster than GDP, over the long-term.

This approach is evident throughout all of Anchor’s strategies. Anchor’s Dividend Income strategy, in particular, comprised only of dividend yielding stocks, takes this investment approach to its fullest extent. Anchor’s preference for dividend yielding stocks is one of the many ways we strive to provide our clients with downside protection during periods of market volatility and generate competitive long-term returns.

Anchor’s Dividend Income strategy is also differentiated in terms of high exposure to small and mid-cap stocks. We firmly believe we have an edge in picking small and mid-cap stocks, and have built a reputation through performance over more than three decades. Furthermore, Anchor’s Dividend Income strategy selects dividend paying stocks across sectors rather than focusing on just the highest dividend paying sectors. This can help reduce the overall risk in the portfolio.

Exhibit 1

Anchor Dividend Income Value Strategy – Investment Process

Exhibit 2

Anchor Dividend Income Value Portfolio Characteristics [2]

Source: FactSet financial data and analytics

Source: FactSet financial data and analytics

Summary:

As we have seen, dividends can be an important component of total return over many market cycles, with dividend paying stocks having outperformed non-dividend paying stocks over the long-term.19 History shows that dividends typically play a vital role in managing volatility and creating stable returns. Given elevated inflation and rising interest rates, we may see challenging market conditions persist for some time.

Anchor’s Dividend Income Value Strategy focuses on high quality[3] companies that seek to grow dividends over time. If history repeats itself now may be the right environment to consider an increased exposure to dividend paying strategies.