IRS Rates [1] | April 2024

- Applicable Federal Rate

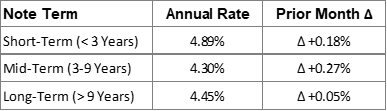

Applicable Federal Rate (“AFR”) is the lowest interest rate allowed by the IRS without having a loan be deemed a gift. The purpose of this restriction is to prevent gifts being disguised as loans (i.e., parents “loan” kids $1MM at 0.00% rate). When AFR rates are low, there are a lot of creative ways to manage liquidity, capitalize trusts, and handle interfamily finances using Promissory Notes. When rates are high, estate vehicles like Charitable Remainder Annuity Trusts (“CRATs”) become more attractive as the up-front charitable deduction is larger.

- §7520 Rate

![]()

The §7520 Rate is related to the valuation of long-term or future interests. It’s most commonly utilized with GRATs, annuities, and estates. The rate is based off the Mid-Term AFR rate (120%, rounded to the nearest two-tenths).

Legislations, Guidance, & Judicial Cases

PRESIDENT BIDEN ANNOUNCES $7.3 T BUDGET AGENDA IN SOTU ADDRESS [2]

During President Biden’s State of the Union address, he presented details of his administration’s FY 2025 budget and tax agenda for a potential second term. The initiatives are largely seen as an expanded version of his 2020 campaign, with a clear focus on raising revenues through increased taxes on corporations and households with over $400K of income.

The below includes a non-comprehensive list of the tax items included in the budget.

- Corporations.

-

-

- Increased Tax Rate. The proposal would raise the corporate tax rate from 21% to 28%.

- Establish Minimum Tax Rates. Corporations would be subject to a minimum tax rate of 21% domestically, and large multinational corporations would be subject to the Organization for Economic Cooperation and Development’s (“OECD’s”) 15% global minimum tax.

- For reference, EU member states, Australia, Japan, and the UK have all adopted the OECD’s global minimum tax, however approval within in US falls on members of Congress who have expressed concerns.

- Increased Excise Tax on Buybacks. Corporations are currently subject to a new 1% excise tax for any corporate stock buyback programs. The plan would increase this to 4%.

- Excess Compensation Deduction Cap. The proposal would expand the current $1 MM cap on deductible executive compensation to apply to all employees

-

- Individuals.

-

- Minimum Tax on Ultra Wealthy. The proposal would impose a 25% minimum tax on households with wealth over $100 MM. As a pending Supreme Court case may ultimately decide the future fate of any wealth tax proposals, this minimum income tax rate is the administration’s answer to a potentially unfavorable Court decision.

- Of note, most tax and political analysts believe any wealth-related measures are largely just political positioning, as the operational structure required to value household net worth would be a near-impossible task for the IRS.

- Increase Payroll Tax for Wealthy. The proposal would increase the Medicare payroll tax rate for income above $400K. The revenue would also be demarcated for the Medicare Hospital Insurance Trust Fund, as opposed to keeping the revenue fluid for other social programs.

- Extend Individual Tax Breaks For Most. As it currently stands, the individual tax reductions made by the Tax Cuts & Jobs Act of 2017 are set to expire in 2026. The proposal would extend the individual tax rate reductions for those making $400K or less.

- Temporary Home Buyers Tax Credit. The proposal would create a $10K tax credit for first-time buyers, as well as a one-year tax credit for current homeowners who sell their starter homes. Both credits would be available to households earning less than $200K, and they would only be available for 2024 and 2025.

- Minimum Tax on Ultra Wealthy. The proposal would impose a 25% minimum tax on households with wealth over $100 MM. As a pending Supreme Court case may ultimately decide the future fate of any wealth tax proposals, this minimum income tax rate is the administration’s answer to a potentially unfavorable Court decision.

-

The administration’s budget should be viewed more through the campaign lens as political positioning before November’s election, as opposed to a viable tax proposal in the current split Congress environment. As the Tax Policy Center noted, “while Biden spoke to lawmakers, they were not really his audience – 2024 voters were”.

SENATE BILL AIMS TO CURB ESTATE TAX STRATEGY UTILIZED BY WEALTHY [3]

Senate Finance Committee Chair Ron Wyden (D-OR) and Senator Angus King (I-ME) introduced the Getting Rid of Abusive Trusts Act (“GRATs Act”), a measure that would restrict the use of certain irrevocable trusts.

At a high-level, grantor-retained annuity trusts (“GRATs”) are irrevocable trusts that can lower the value of an individual’s estate, therefore reducing any potential federal estate tax liability.

The proposal would restrict the use of GRATs via the following:

- Increase a GRAT’s term to a minimum of 15 years and a maximum of the life expectancy of the annuitant, plus 10 years;

- Eliminate any annuity reductions during the GRAT term;

- Establish a minimum value for the remainder interest for gift tax purposes; and

- Treat transfers between a trust and the deemed owner as a sale or exchange (i.e., a taxable event).

While it is not likely the bill would pass in today’s Congress, there have been increased calls for reform around grantor trust abuse in recent years. This proposal is notable as it includes specific actionable items, and because it’s sponsored by the Senate Finance Committee Chair.

UNLIKELY SENATORS JOIN FORCES TO TACKLE TAX-FREE MERGERS [4]

Senators Sheldon Whitehouse (D-RI) and JD Vance (R-OH) introduced the Stop Subsidizing Giant Mergers Act, a bill that would reshape corporate mergers & acquisitions.

Under Section §368 of the Tax Code, certain mergers and acquisitions can qualify as tax-free reorganizations. As an example, transactions where the acquiring corporation exchanges stock for the target firm’s assets are deemed tax-free if structured correctly. In fact, this popular method accounted for 40% of all mergers in the US since 2007.

The proposal would eliminate these tax-free mergers, meaning shareholders of an acquired firm who receive stock through this structure may immediately owe capital gains taxes. Of note, the bill makes an exception for companies with average annual revenues below $500 MM for the prior three years.

Despite the bipartisan sponsors, the bill is not likely to gain enough support for a vote in either Congressional chamber.

HOUSE REPS REACH ACROSS THE AISLE FOR DRAFT BEERS [5]

Representatives Darin LaHood (R-IL) and Steven Horsford (D-NV) introduced the Creating Hospitality Economic Enhancement for Restaurants and Servers (“CHEERS”) Act.

For almost two decades, Section §179D in the Tax Code has provided a deduction for qualifying investments in energy-efficient systems in commercial buildings. The deduction is fairly generous, allowing building owners to claim up to $5.00 per square feet for energy-efficient buildings or system installations.

The bipartisan measure would expand a tax incentive for energy-efficient systems to include new keg, tap, and draft line property in commercial bars, restaurants, and entertainment venues. According to bill sponsors, draft beer is the most sustainable method for packagers, retailers, and suppliers. As such, expanding Section §179D would aim to incentivize installing the energy-efficient system while also providing support to an industry that is still recovering from COVID (i.e., restaurants, bars).

The proposal was publicly applauded by hospitality groups and industry stakeholders.

Other Headlines

Domestic Headlines

- IRS Launches Free Filing Software. The IRS launched its pilot for Direct File, a free online filing system that would compete with third-party programs like TurboTax and H&R Block. The program is restricted to federal income taxes for those with relatively simple financial situations (i.e., no itemizing, W-2 income). The pilot is available for taxpayers in Arizona, California, Florida, Massachusetts, New York, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. [6]

- Florida Man Arrested for Hiding $20 MM. The DOJ arrested a Florida businessman for hiding over $20 MM of assets from the IRS between 1985 and 2020. The individual used Credit Suisse Group, UBS, and other Swiss banks to avoid foreign asset disclosures. As part of the investigation, the DOJ is trying to determine whether Credit Suisse broke its 2014 please agreement where they agreed to increase transparency with the IRS. [7]

- Georgia Legislators Approve Tax Cut. The Georgia State Senate passed two House-approved bills that would cut $500 MM in individual and corporate taxes. The first bill would fast-track an already scheduled individual state income tax reduction, at an additional cost of $360 MM, while the other would reduce the corporate income tax in multi-year stages. [8]

- Illinois Considers Eliminating Grocery Tax. Governor JB Pritzker proposed eliminating the state’s 1% sales tax on groceries, but he may be met with some pushback from local governments. In Illinois, the state collects the grocery sales tax revenue but transfers the funds within a jurisdiction to the local government. Some cities would lose $580K to $3 MM of estimated annual revenue, and Chicago is estimated to lose $80 MM. The Governor’s plan allows for municipalities to levy their own grocery sales tax, however they would then also be responsible for the collection. [9]

- New York Court Allows Property Tax Challenge to Advance. Tax Equity Now New York (“TENNY”), a group consisting of property owners, renters, and other advocacy groups, filed a lawsuit claiming New York’s property tax system is inequitable and puts a burden on lower-income families. The tax system currently assessed homes with equivalent values at different rates depending on their neighborhood location, and not in a straightforward manner. In the complaint, TENNY showed an example where a property in Canarsie was assessed at triple the rate of an equivalent property in Park Slope. The New York State Court of Appeals voted 4-to-3 to advance the lawsuit to the state’s highest court. [10]

- Wisconsin Expands Child Care Tax Credit. Governor Evers signed the state legislation to expand Wisconsin’s child care tax credit. Tax filers were originally able to claim a state credit equal to 50% of the federal amount, but the bill increased the threshold to 100%. The Governor’s office estimates over 110K taxpayers will see an average benefit of $656 per filer. [11]

International Headlines

- International Art Dealer Sentenced For Tax Fraud. Guy Wildenstein, an art family patriarch and president of international art dealer Wildenstein & Co., was found guilty of a tax fraud and money laundering scheme. A French court sentenced him to four years in prison with a $1.08 MM fine after he was accused of hiding significant family art and other assets using shell companies to avoid paying French inheritance taxes.[12]

- Russia Considers Tax Hike to Fund Ukraine War. President Vladimir Putin announced a plan to overhaul Russia’s tax system in an effort to raise up to $44 B USD to further fund the war in Ukraine. The proposal would include a 5% increase on corporate and individual taxes to 25% and 20%, respectively. The latter would only be applied to those earning more than $55K USD. For reference, recent estimates put the average annual salary in Russia at approximately $9,700 USD. [13]

- Spain Accuses Real Madrid Manager of Tax Fraud. Carlo Ancelotti, the decorated soccer manager of Real Madrid, was accused of tax fraud by Spanish state prosecutors. He allegedly hid income from his image rights using a system of shell companies, defrauding the Spanish government of €1 MM in tax revenues. Ancelotti denied any wrongdoing, as well as tax residency at the time of the accusations. [14]

- UK Finance Minister Announced Tax Rate Changes. After going back and forth on the viability of income tax cuts in the UK, Finance Minister Jeremy Hunt announced a 2% reduction in the national insurance rate, bringing it to 8%. As he ultimately had to keep income tax rates steady, the move is seen as a consolation prize to his initial campaign promise of sweeping tax reductions. [15]