IRS Rates [1] | March 2024

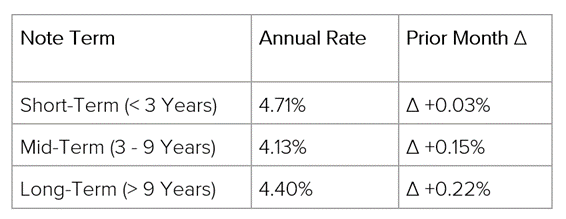

- Applicable Federal Rate

Applicable Federal Rate (“AFR”) is the lowest interest rate allowed by the IRS without having a loan be deemed a gift. The purpose of this restriction is to prevent gifts being disguised as loans (i.e., parents “loan” kids $1MM at 0.00% rate). When AFR rates are low, there are a lot of creative ways to manage liquidity, capitalize trusts, and handle interfamily finances using Promissory Notes. When rates are high, estate vehicles like Charitable Remainder Annuity Trusts (“CRATs”) become more attractive as the up-front charitable deduction is larger.

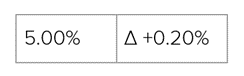

- §7520 Rate

The §7520 Rate is related to the valuation of long-term or future interests. It’s most commonly utilized with GRATs, annuities, and estates. The rate is based off the Mid-Term AFR rate (120%, rounded to the nearest two-tenths).

Legislations, Guidance, & Judicial Cases

Senate GOP Put Brakes on $78 B Tax Bill [2]

Senate Finance Committee Ranking Member Mike Crapo (R-ID) issued a statement criticizing the Tax Relief for American Families and Workers Act. The bill, which was negotiated by Senate Finance Committee Chairman Ron Wyden (D-OR) and House Ways and Means Chairman Jason Smith (R-MO), would expand the Child Tax Credit and restore a number of popular business tax breaks.

The measure passed the House in a bipartisan 357-to-70 vote, and supporters were hopeful it would move through the Senate relatively quickly, whether as a standalone vote or as part of a government funding bill.

Senator Crapo’s criticisms focused on the proposed expansions to the Child Tax Credit, namely the idea of including refundable portion. While his opposition puts the brakes on a quick approval, his statement made it clear that he is “still working with [his] Senate colleagues to reach consensus on a path forward”.

For reference, the House-passed version of the Tax Relief for American Families and Workers Act included the following provisions.

- Child Tax Credit. The refundable portion of the credit will increase from $1,600 to $1,800 and will be adjusted for inflation going forward. The expansion will be a phased increase for 2023, 2024, and 2025. The phase-in would also apply to families with multiple children.

-

- While the expansion does not go as far as most Democrats had wanted, an independent budget study showed this minor change could lift 400,000 children out of poverty alone.

- Research & Development. Originally, businesses could fully expense their R&D costs in the year they were incurred. The TCJA changed the rules to require businesses to amortize expenses over a five-year period, or 15 years for international research. This deal would restore the benefit to the original structure and the change would be retroactive from 2022 through 2025.

- Bonus Depreciation. Prior to 2023, businesses were entitled to a bonus depreciation where they could deduct the full cost of qualifying business assets with lives of 20 years or less. The 100% write-off fell to 80% for 2023 and was set to fall to 60% for 2024, 40% for 2025, and so on. The deal would extend the bonus depreciation benefit further.

- Interest Deductions. The TCJA limited many large businesses from writing off their net interest to 30% of adjusted taxable income while also disallowing interest carry forwards. The deal would restore the net interest to the original structure with no cap.

- Misc. The deal would also expand various low-income housing tax credits and tax breaks for victims of natural disasters. According to Wyden & Smith, the entire bill will be paid for by sunsetting the COVID-era Employee Retention Credit. Notably, the ERC is at the center of a number of fraud-ridden cases.

Bipartisan Bill Aims to Enhance Paid Family and Medical Leave Tax Credit [3]

Senators Deb Fischer (R-NE) and Angus King (I-ME) introduced the Paid Family and Medical Leave Tax Credit Extension and Enhancement Act, a bill that would expand the corporate tax credit related to paid family and medical leave (“PFML”) benefits offered to employees.

For reference, the Tax Cuts and Jobs Act of 2017 created a new general business tax credit under §45S for employers that offered up to 12 weeks of PFML to their employees, among other requirements. Citing the positive impacts attributed to the credit, Senator Fischer & Senator King’s bill aims to further enhance §45S.

The below includes a non-comprehensive list of the notable proposals.

- Make the Credit Permanent. The credit was initially established on a temporary basis and subsequently extended through 2025. The bill would make the credit permanent, ensuring businesses do not reverse PFML benefits in 2026.

- Addressing State or Local Mandates. Under current law, employers who provide qualifying PFML but under state or local government mandates are ineligible for the §45S credit. This created unique situations where corporations with operations in both non-mandate and mandate states are deemed credit ineligible. The bill would address this issue by allowing these employers to receive the tax credit, so long as their PFML benefit is in excess of the state mandate.

- Paid Family Leave Insurance Premium Coverage. The bill would allow for employers to claim a credit for up to 25% of the annual premiums they pay for any Paid Family Leave Insurance (“PFLI”) plans. PFLI has increased in popularity as an alternative to self-financing, especially as small businesses are not always able to self-finance expanded PFML benefits.

- Reduction In Minimum Employment Requirements. Under current law, an employee must be with their employer for at least 12 months to receive PFML benefits and have the employer receive the tax credit. With that said, Senator Fischer & Senator King point out that almost 30.6% of those between 25 to 34 years of age (i.e., those most likely to need access to PFML) have tenures of less than a year. As such, the bill would reduce the employment requirement to 6 months, allowing more employers to receive the credit.

Other Headlines

Domestic Headlines

- Georgia Considering Tax Holiday for Firearms. Some state lawmakers are working to pass a five-day sales tax holiday on all guns, ammunition, and gun safes in the period leading up to Georgia’s deer hunting season. While the measure passed the state senate, it has a tougher battle in the House as some lawmakers want to narrow the tax break to only apply to firearm safety devices.[4]

- Hawaii to Consider Tourist Tax. State lawmakers are working with Governor Green on a potential tourist tax. Under initial proposals, the state – which hosted 10 MM visitors last year – would charge a $25 fee for hotel or short-term rental check ins. The proceeds would be demarcated for the conservation of natural resources as the state continues to use funds on recovery efforts from last year’s Lahaina wildfires.[5]

- Massachusetts’ Sports Betting Tax Revenue Twice Their Projections. During its first year of sports betting, Massachusetts collected approximately twice as much as they had initially projected. Sportsbooks reported more than $542 MM in taxable revenue between February 2023 and January 2024, with Massachusetts bringing in $108 MM of tax revenue.[6]

- Montana Creates Tax Force to Battle Property Tax Increases. Governor Gianforte created a task force made up of state lawmakers, local leaders, and policy experts that would tackle the state’s rising property taxes. In their initial meeting, the Governor presented the group’s goals which include slowing the tax’s growth rate, encouraging public participation in the process, and ensuring all low-income residents are able to remain in their homes. However, the Governor also said proposals would have to ensure public schools remain adequately funded, and no proposals can include the introduction of a state sales tax.[7]

- Michigan Courts To Rule on Income Tax Increase. In 2015, Michigan enacted a law that would trigger income tax cuts when the state’s revenue outpaces inflation by a specific amount. This was recently triggered, decreasing the state income tax rate from 4.25% to 4.05%. However, the Michigan Department of Treasury says the rate reduction is only meant to last a year unless the revenue triggers are met once again. The Mackinac Center for Public Policy subsequently sued, claiming the law is meant to provide permanent tax relief. The state’s Court of Appeals will now decide on how the 2015 should have been interpreted.[8]

- Minnesota’s New Child Tax Credit Takes Effect. Last year, the state enacted a new child tax credit that would allow Minnesotans to claim a credit of up to $1,750 per dependent on their 2023 returns. Governor Tim Walz, along with many state lawmakers, has been trying to raise awareness of the credit as a study showed it could reduce the state’s child poverty by 33%.[9]

- New Jersey Governor Proposes $3.5 B Tax Relief Plan. As part of New Jersey’s fiscal year budget, Governor Murphy announced his plan that includes $3.5 B in tax relief. Included in the plan are property tax relief measures and expansions of the child tax credit and earn income tax credit. The budget would also continue funding for state programs such as ANCHOR, StayNJ, and Senior Freeze. It would also provide the initial funding of RetireReady NJ, a state-created retirement savings plan for private sector employees that was created in 2019.[10]

- New Mexico Lawmakers Pass $272 MM Tax Package. The New Mexico state legislature passed a FY2025 budget that included $272 MM of individual tax cuts, mainly composed of various credits such as a clean car tax credit. The budget will now go to Governor Grisham’s desk for final approval, noting much of the package was sourced directly from the Governor’s agenda.[11]

- Oklahoma Repeals Grocery Sales Tax. Governor Stitt signed the state legislation to eliminate Oklahoma’s 4.5% sales tax on groceries. The repeal will go into effect in August, with the average Oklahoma family projected to save $648 annually.[12]

- Pennsylvania Considers Legalization To Increase Revenue. During Governor Josh Shapiro’s budget remarks, he brought up the idea of legalizing recreational marijuana use with a hefty 20% sales tax. Citing examples of nearby states (i.e., New Jersey, New York), the Governor’s plan is projected to generate $255 MM of new tax revenue within the first year. His proposal included a multi-year plan to use $500 MM for restorative justice purposes, $5 MM for Department of Agriculture operations, $2 MM for state police enforcement, and $500K for Department of Revenue administration. For any legalization to kick in for 2025, legislation would have to be passed before July 1st.[13]

- Tennessee Lawmakers Propose Surtax on Firearm Sales. State lawmakers filed a House bill that would levy a 15% surtax on the retail sale of all firearms within the state. The measure would demarcate any revenue raised from the surtax to help fund salaries of school counselors in elementary and secondary schools. It’s unclear if the bill will collect enough votes in the House, but state legislators in the Senate have already signaled their strong opposition.[14]

- Washington Considers Tax Breaks for Commercial Property Conversions. State Senator Yasmin Trudeau proposed a bill that would offer property tax breaks to developers who convert their commercial-use properties into residential housing. The bill comes at a time when Washington, like many other states, is experiencing a housing shortage along with a plethora of empty office buildings.[15]

International Headlines

- Hong Kong Raises Taxes On High Earners. For the first time in two decades, Hong Kong will raise their income taxes. The government will implement a two-tiered income tax system, with those making HK$5 MM or less continuing to face a 15% tax. Those with income above that threshold will see a higher 16% rate. The estimate is expected to bring in HK$910 MM of new tax revenue, which will help lower the city’s HK$101.6 B fiscal deficit.[16]

- UK Finance Minister Reverses his Reversal on Tax Cuts. In an interview with ITV, Finance Minister Jeremy Hunt said the British government’s economic forecasts show there isn’t a lot of room to make tax cuts in the near future. Despite initial campaign promises from the current government, Hunt kept tax cuts off the table for months until it was recently reported that they were exploring individual rate cuts pending a review of the economic forecasts. [17]