Investing in Mid Cap stocks can offer the stability of Large Cap stocks with the growth component of Small Cap stocks.

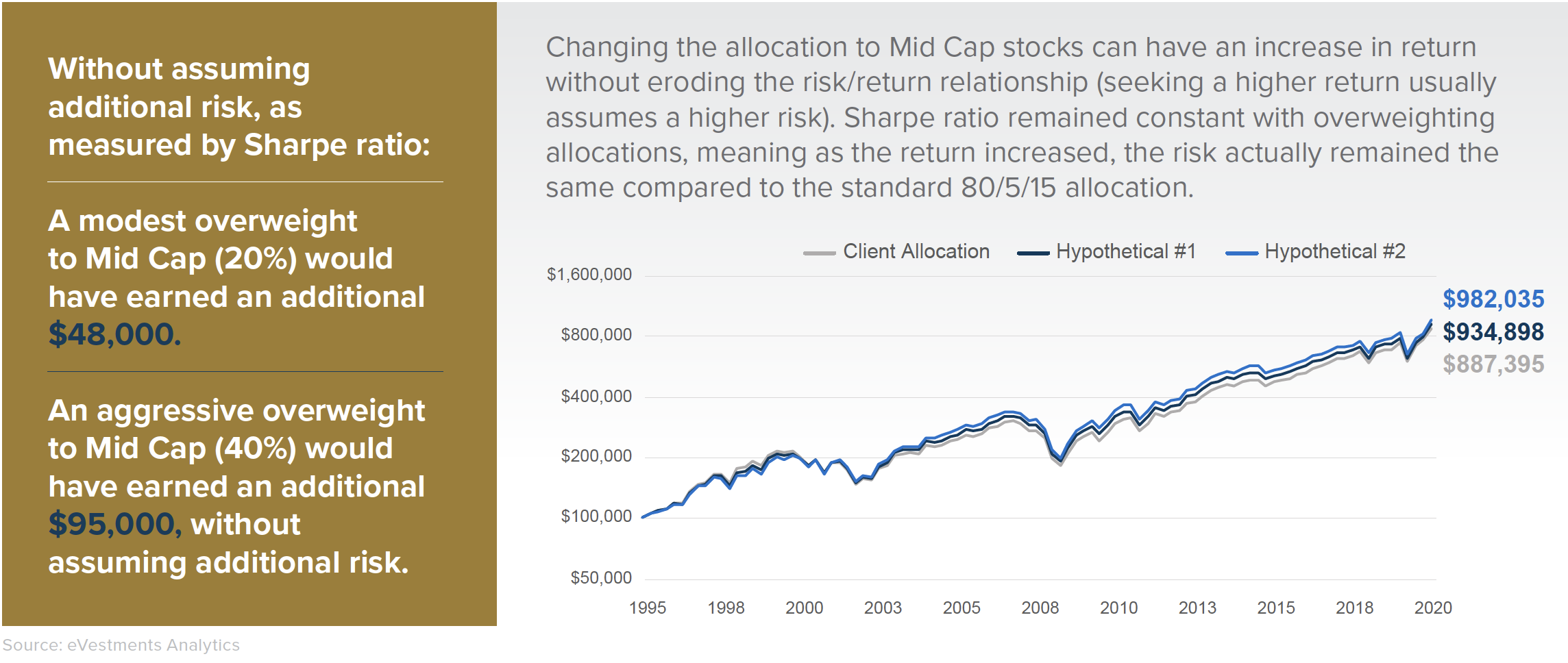

Can small changes to Mid Cap allocations have positive long-term outcomes for an overall portfolio? In this scenario, we take a look at a client allocation covering a 25-year period for an investor with the following asset allocation: 80% Domestic US Equities (55% Large Cap, 15% Mid Cap, 10% Small Cap), 5% International Equities, and 15% Fixed Income.

- In Hypothetical Model 1, we overweight Mid Cap by 20% and underweight Large Cap by 20%

- In Hypothetical Model 2, we overweight Mid Cap by 40% and underweight Large Cap by 40%

WHEN OVERWEIGHTING THE MID CAP ALLOCATION, WHAT HAPPENS TO THE RISK/RETURN?

For further insights, contact us today. Click here to download a PDF of this article.