China continues to dominate headlines and has become an increasingly important topic of discussion in the investment community over the last few years and for good reason. When China was just a small player on the world stage, the consequences of its actions may have been negligible. However, given the extent of China’s global scale and integration today, the ramifications of its actions are much greater and widespread. As China becomes an even bigger part of the global economy and its domestic companies grow larger, China’s representation in major equity and bond indices is also likely to increase over time. At Anchor, we feel it is important to have a deep understanding of the major components of the evolving global economy and certainly China can be considered an integral part of developing this understanding.

Why China Matters

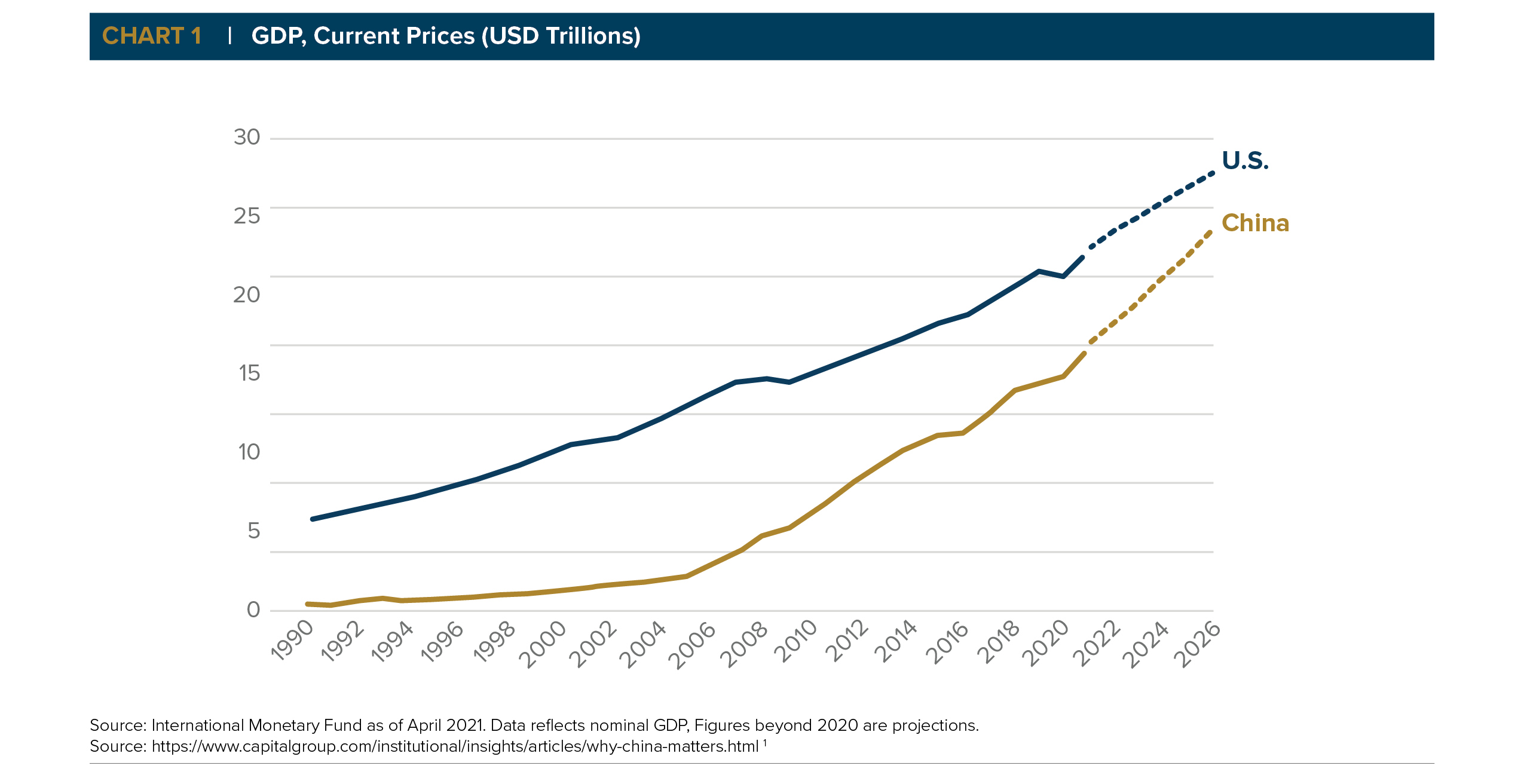

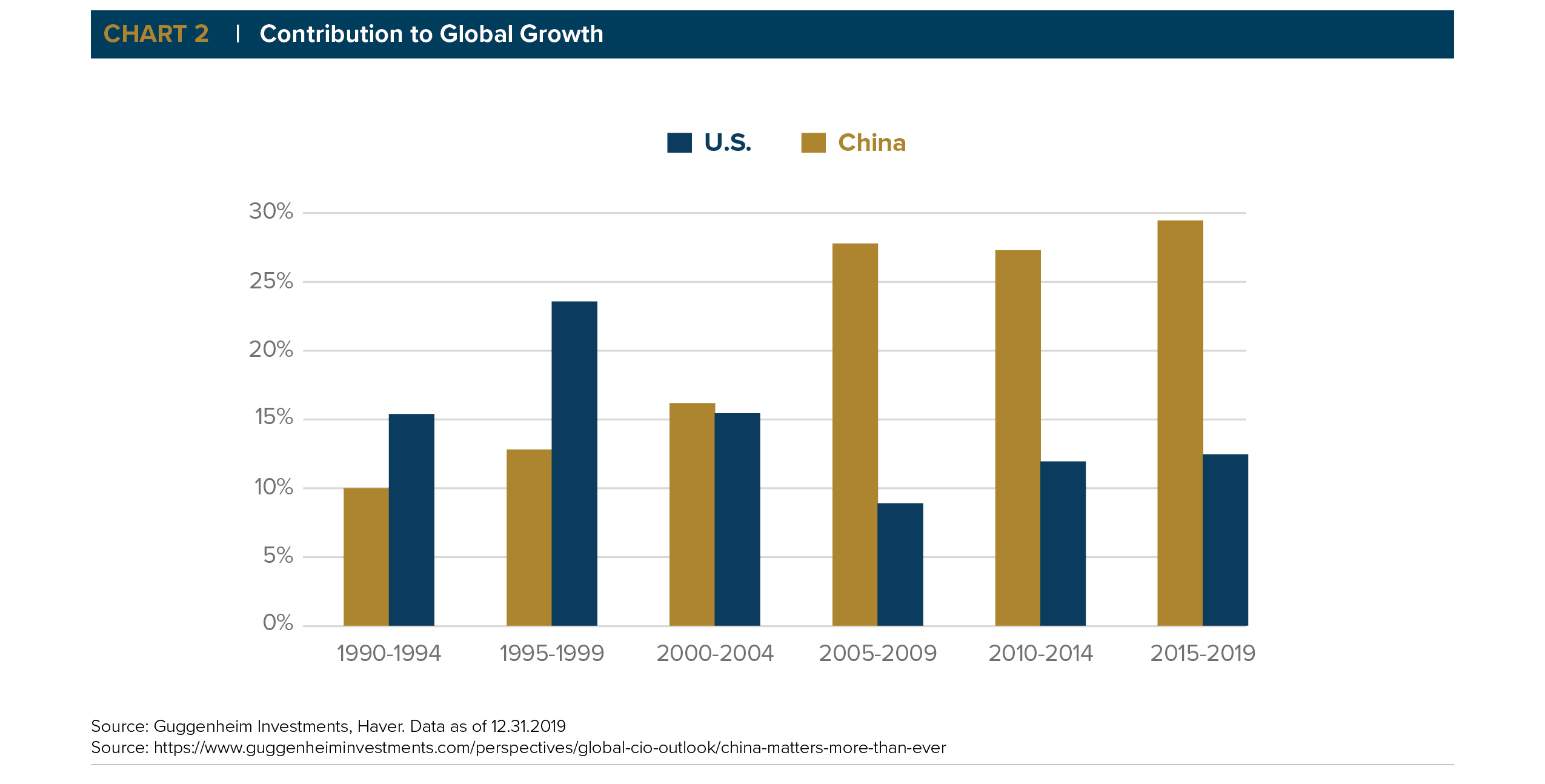

China has the 2nd largest economy in the world behind the United States and is home to more than 120 Global Fortune 500 companies. It has contributed to more than 1/3rd of global GDP growth over the past decade and is expected to contribute 25-30% of the world’s growth over the next decade.2By 2030, China is expected to account for well over 20% of the world economy.3

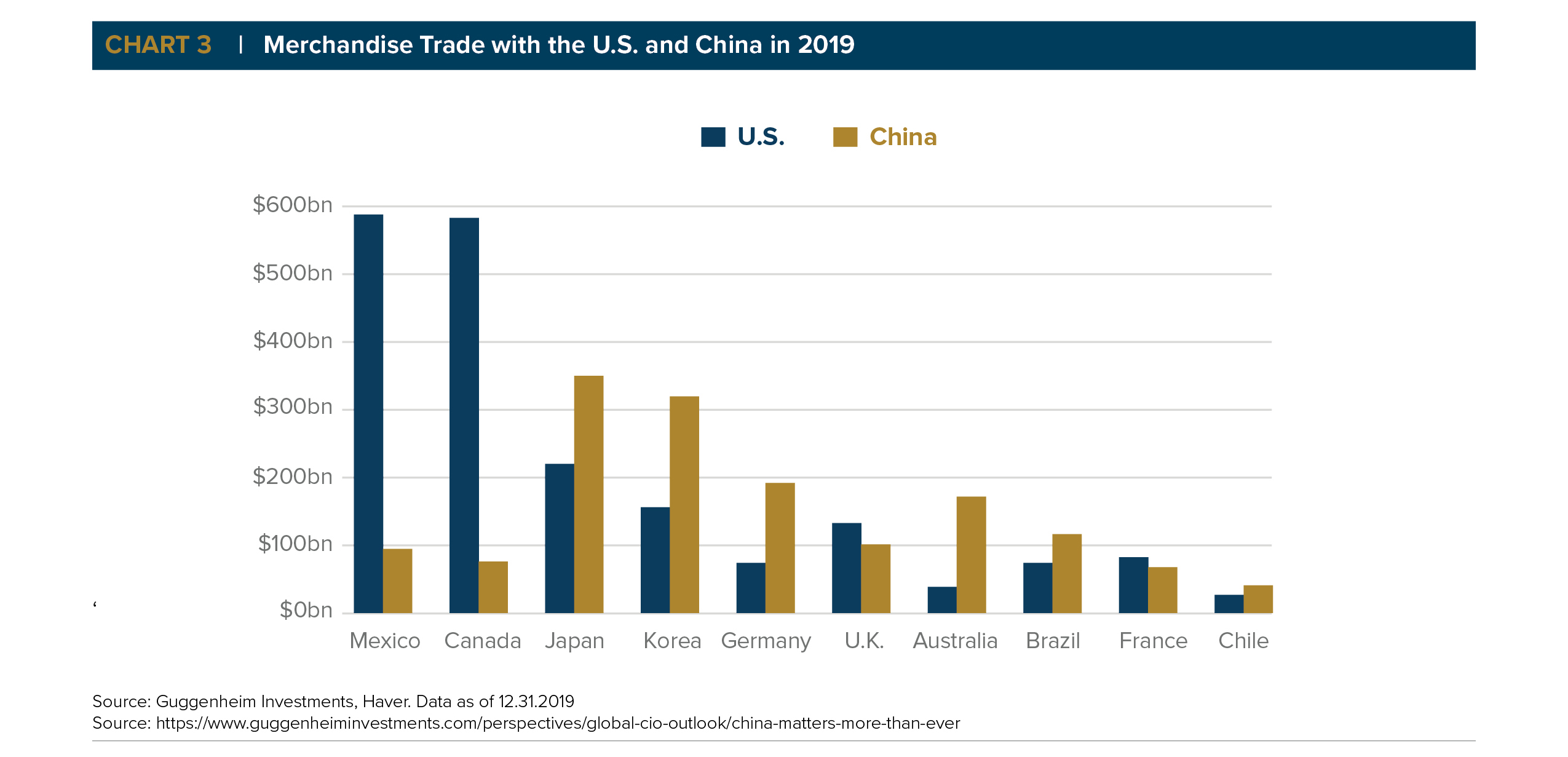

Perhaps more important is the fact that the U.S. economy and virtually all economies around the world are heavily intertwined with China. China is the largest trading partner for many countries, is an integral part of the supply chain for a large amount of individual companies, and a major source of demand for many others.4

On the demand front, a report published in 2019 by McKinsey showed that across 24 major consumption categories studied, China had an average 18% share of the global market. Chinese consumers accounted for more than 40% of electric vehicle sales, 30% of global car sales, 24% of wine sales, and 22% of womenswear. Even more startling, in some of these industries, such as auto sales, China accounted for more than 50% of global growth over the previous decade.5

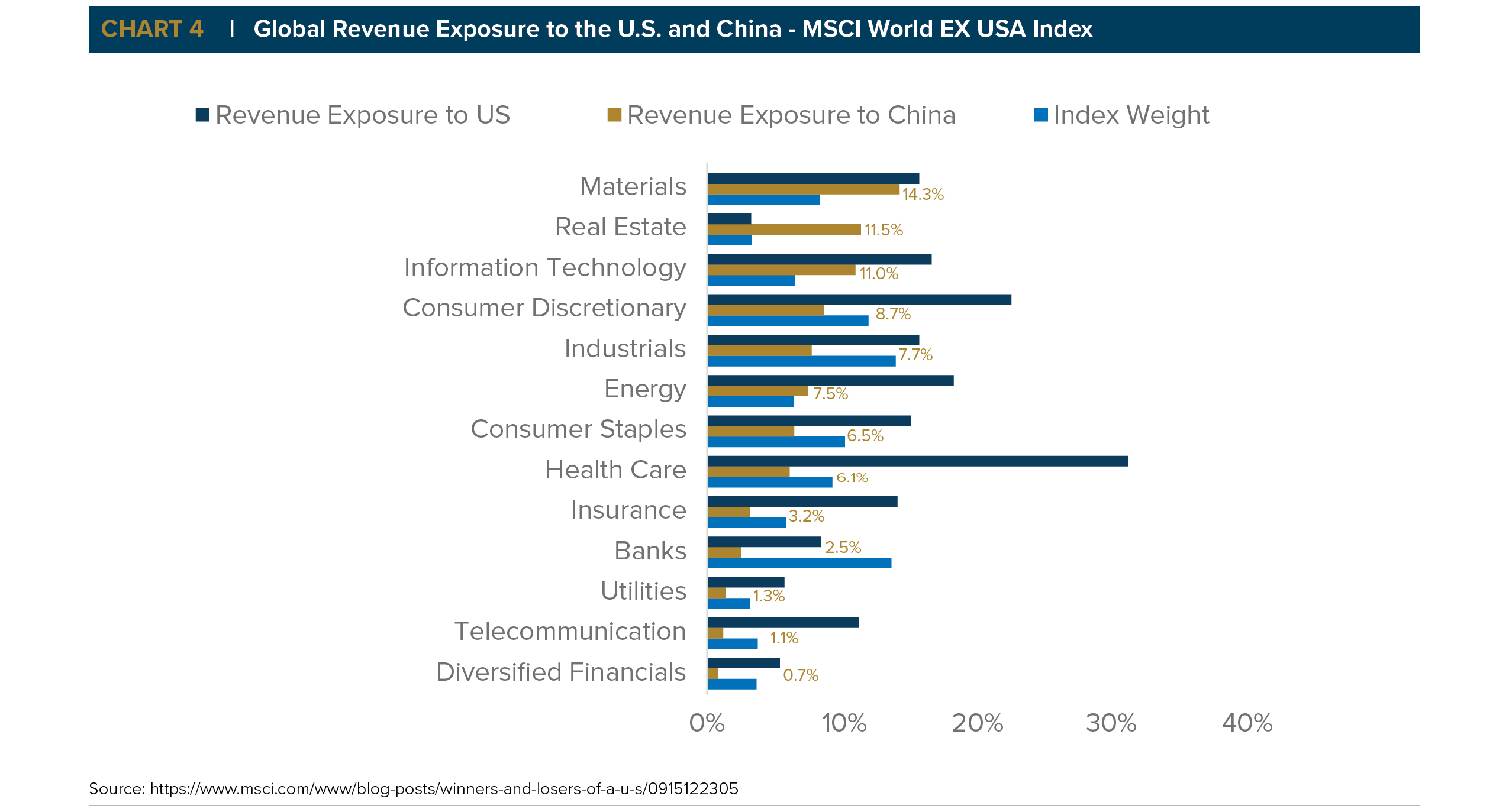

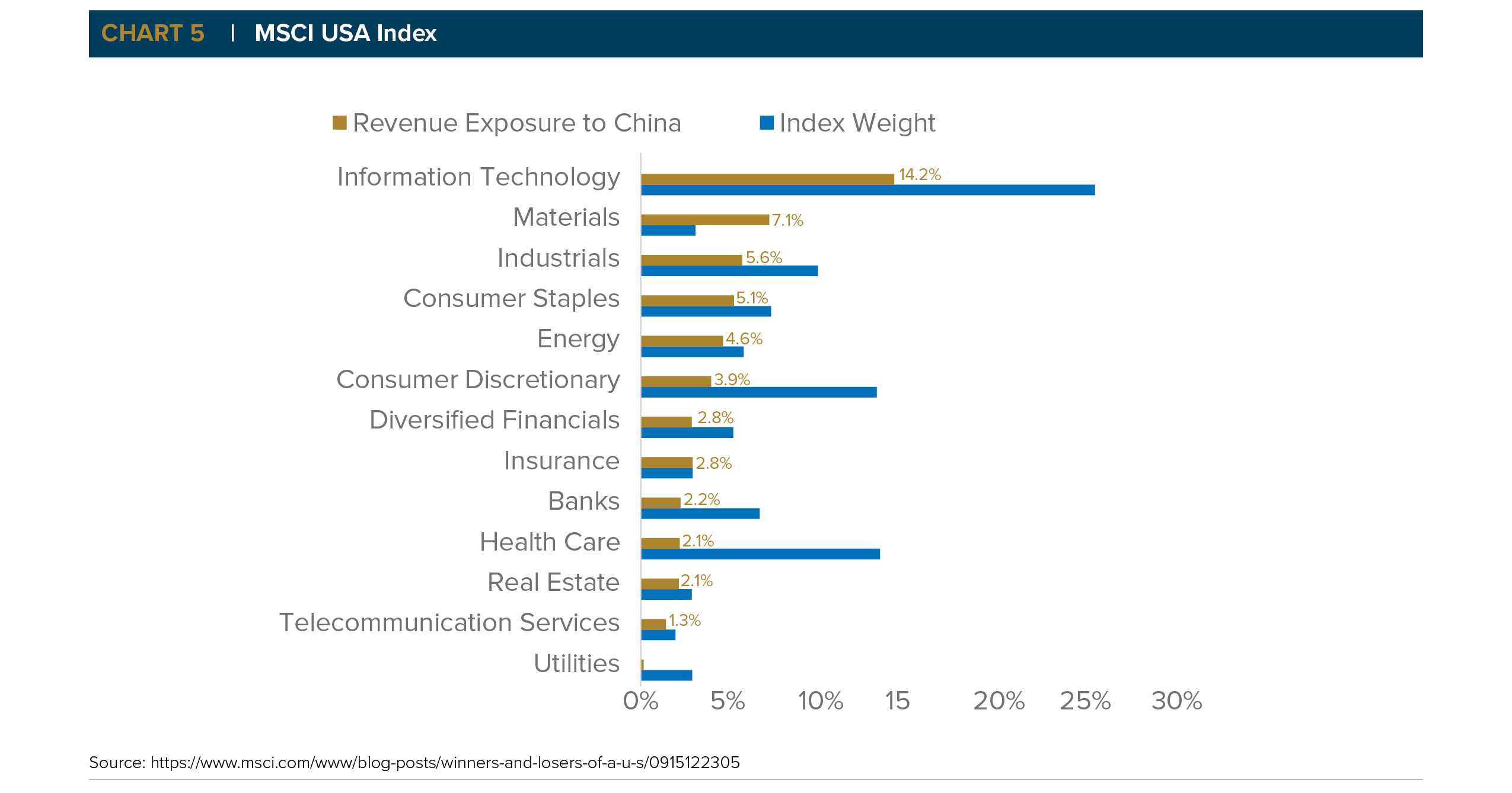

In another study published by Boston Consulting Group in 2020, BCG found seven major U.S. industrial sectors—consumer electronics, motor vehicles and parts, aerospace, medical supplies, medical equipment, machinery, and enterprise hardware— derived 7% to 16% of their global revenue from China. In total, BCG concluded U.S. companies had around $410 billion of revenue at risk in China.6

A recent report published by Bank of America may highlight best just how much exposure individual companies have to China. BofA found that:

• Up to 25% of the revenues generated by companies held within U.S. exchange traded funds (ETFs) are derived from salesto China.7

• 79 S&P 500 companies generate at least 5% of their revenues from China.8

• The correlation between earnings per share growth of the constituent companies in the S&P 500 and China’s GDP growthwent from zero in 2000 to 90%.9 Essentially, China’s GDP growth has been a bigger driver of returns for many U.S.-listed stocks than U.S. GDP growth. In total globally, BofA identified 303 publicly listed companies around the world that generated at least 5% of their revenues from China.10 We highlight the above not only to demonstrate how important China is to the global economy but also to show investors that avoiding all risk as it relates to China is more difficult than one might expect. In fact, revenue exposure, which we have primarily highlighted above, is just one of the many ways to evaluate a sector or individual company’s vulnerability to China. Many other linkages exist such as broader trade, supply chain, and labor dependencies. Thus, investors cannot completely eliminate their exposure to China simply by choosing not to invest directly in Chinese companies.

Challenges and the Future for China

ChinaWhile China has grown at a rapid pace for the better part of three decades driven by investment, its economy is now in transition.11 As labor and land costs continue to grow and citizens benefit from rising incomes and technological advances, China will continue moving more towards a services and consumption-driven economy.12 Services and household consumption still contribute a much smaller percentage of GDP growth in China relative to developed economies meaning there is plenty of room for further development in the future.13 BCG expects the services sector to play an important role in driving China’s growth over the next decade, estimating services will contribute ~61% of GDP in 2030, up from ~54% in 2019.14 For reference, U.S. consumption accounts for roughly 68% of GDP.15 China’s growth and investment prospects should benefit from the shift in the economy towards consumption over the long run.

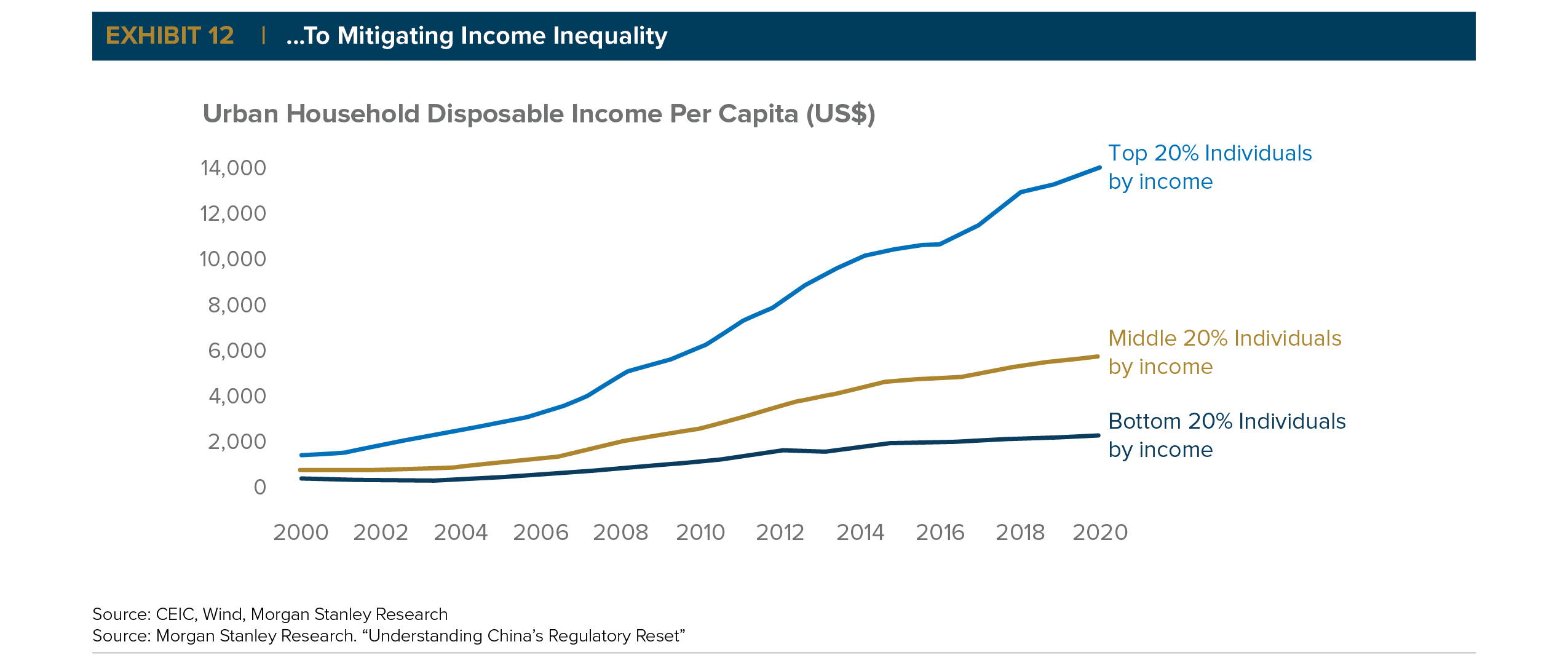

In the short-term, however, China faces several challenges in its growth model. Its debt levels have soared over the last 20 years and its population is aging with the working age population declining every year since 2015.16 This decline has weighed on the savings rate and will continue to as the population aged 55 or above moves from 25% of the total population today to 33% in 2030.17 Further, China is the world’s largest polluter and does not foresee a scenario where it can begin to reduce emission levels until at least 2030.18 China is still also heavily reliant on foreign technology, using global standards for more than 90% of its technologies.19 Arguably most important, however, is that income inequality has widened to its highest levels ever at a time when the country’s GDP growth has been slowing to its lowest levels in a very long time.20 This is clearly a major issue for a Communist country whose system is built on the idea of “common prosperity.”

We believe the government is able to alleviate and manage a lot of these economic risks because it has an internally controlled economy as well as leader in President Xi Jinping who is motivated to show positive outcomes given his 10-Year Term is approaching. In fact, in a speech earlier this year, President Xi indicated that China would be shifting from a growth first mentality to one that better balances growth and sustainability.21 In his 2012 Inauguration Speech, Xi talked about doubling the national income level and eliminating absolute poverty. This year, however, Xi said China had achieved victory in ending extreme poverty and will target reaching “common prosperity” in the next stage of development. He then introduced a range of metrics outside of economic growth that included areas such as social equality, supply chain self-sufficiency, data security, and de-carbonization.22

China’s Key Priorities

Understanding China’s priorities is key to understanding much of what is happening there. China has followed an economic policy that is very independent from the rest of the world under President Xi. This started to become clear with China’s Five Year Plan laid out in 2015 and has remained consistent in each of China’s Five Year Plans since as well through President Xi’s speeches.23 China no longer wants to be known for its cheap labor and managed currency or seen as a low-quality manufacturer. It wants to advance up the value chain and reduce its reliance on manufacturing and exports as the primary source of growth. It wants to forge a path to greater self-sufficiency, particularly in the areas of science and technology. In short, the Chinese want to be the innovators who come up with advanced technologies rather than the ones who assemble it.24

Some of the specific sectors China is focused on include robotics, aviation, advanced railways, new energy vehicles, and biomedicine & high-performance medical equipment, among others.25 They have already achieved significant progress in many of these areas including high-speed rail, electric vehicles, solar panels, wind turbines, and cargo ships as China has dominant domestic companies in each of these sectors. Semiconductors and aircrafts are two areas they have not yet figured out due to the complexity of the technologies but remain of high importance to the government.26

Looking forward, China may lead in the formulation of new standards of emerging technologies that have yet to be defined. So far, China’s innovation in certain areas such as 6G, quantum networks, Internet of Things, new materials, digital payments, blockchain, and autonomous driving are strong.27 The government is subsidizing and promoting many of these technologies through a top-down approach with industrial policies and tax benefits to provide assistance.28 This gives them a leg up on companies taking similar initiatives in places like the U.S. that garner much less governmental support, instead relying primarily on market forces.

Recently Regulatory Reforms

ReformsSince November 2020, there have been over 40 major decrees by the Chinese government.29 The first major one was the government’s decision to halt Ant Group’s IPO as the regulators called for tighter control of online lending and asked the company to separate its payment business from its personal finance business.30 The regulatory crackdown then found its way into other sectors such as the internet, video gaming, and education. The Chinese government drafted rules on unfair competition and fined Internet giants like Alibaba and Tencent while also calling on them to commit a portion of profits each year to social value creation.31 New rules were implemented that limit minors to spending 3 hours per week playing video games.32 The most jolting of the reforms, however, came from the education sector where after school tutoring companies were ordered to cut back most of their activities and convert to not-for-profit organizations, virtually wiping out the sector.33 As J.P. Morgan’s piece “Is China Investible?” points out, “there are clear domestic motivations for each action—the actions against Ant Financial are meant to rein in shadow banking. The actions against Tencent, Alibaba, Baidu, and others are meant to trust bust. The actions against Didi are meant to protect data. The actions against the for-profit education sector are meant to ease the financial burden on households to incentivize higher birthrates.”34

Of course, this is not the first time there have been major regulatory overhauls in China. In fact, Morgan Stanley went back and studied the past 20 years, identifying at least six other regulatory campaigns similar to the one being experienced today. These included illegal mining (2006-2009), food safety (2008-2010), high-end dining and liquor (2013-2014), cross-border investments (2016-2017), gaming (2018), and drug procurement (2018-2019).35 In each case, China’s regulatory environment tended to oscillate between relaxed and tight enforcement. Emerging sectors in particular seem to be allowed to grow unchecked for many years before the government eventually reigns them in through abrupt regulatory resets.36 These regulatory resets can be viewed as a recognition that regulatory oversight has not kept abreast of the expanding reach and influence of a certain sector. The ultimate financial impact of the regulation varies by industry/company, with some regulations raising compliance costs in the short-run while others cause considerable permanent impairment.

One of the things that makes China so different and why these regulatory reforms likely get so much attention is the country’s willingness and ability to undergo such deep structural changes at such a rapid pace. In the U.S., it typically takes years to enact new regulation due to the checks and balances within the democratic political system. However, in China, the system is one of absolute control at the center, allowing the government to make changes at a speed that often catches the world and investment community off guard. The truth is that regulatory risk exists everywhere and markets have demonstrated they can deal with that fact – just look at companies like Google and Facebook in the U.S. that have dealt with headlines about regulation for years but continue to see their stock prices march higher every year. However, the equation is different with Chinese companies because investors can be abruptly wiped out with no forewarning, as is what happened with the after-school tutoring companies.

How China Impacts How We Invest

At Anchor, we do not invest directly in Chinese-listed companies or ADRs. This is not because we do not think there are great Chinese companies. We fully recognize that companies like Alibaba and Tencent are some of the most dominant and profitable businesses in the world with long runways for growth. However, one of our primary focuses at Anchor is protecting downside risk for our clients and the downside risk posed by potential regulation, among other factors, is simply too high in China. We could not sleep well at night knowing that the government could severely impair one of our investments overnight and without forewarning. In addition, we find there to be plenty of attractive investment opportunities in companies outside of China where we do not have to assume the same level of risk but the return potential is just as high.

With all of that said, we do have investments in companies with some form of exposure to China. Our research process entails uncovering these potential vulnerabilities, whether they stem from demand exposure, supply chain and labor dependencies, or others. While these are certainly risks, we think many of them are largely unavoidable given the global nature of companies today as we outlined at the beginning of this paper. Instead, we assess the probability of outcomes to manage these risks and avoid risks that we find to be existential or binary.

Moreover, while we may not invest directly in Chinese companies, we feel it is important to study them. While China still remains behind the U.S. and other countries in certain sectors of the market, they are arguably ahead in others. China is innovating quickly, benefiting from a massive population that is willing to adopt new technologies very quickly. Studying these new technologies may give us a window into the future for how certain industries may evolve in the U.S. and what companies are potentially at risk for disruption. Payments is a great example. In the U.S., debit and credit cards dominate, but in China the payment system bypassed cards and is built almost entirely on digital wallets that use QR codes to pay. Now, we see many companies in the U.S. such as Square and PayPal who are trying similar methods and hoping to ultimately create a system similar to the one in China.

Conclusion

Ultimately, at Anchor, we are primarily focused on bottom-up fundamental investing. While we do not make macroeconomic forecasts, we do attempt to understand the general macro environment in which we are operating. In today’s global economy, it is not enough just to understand only what is happening in the U.S. We must also pay attention to other parts of the world including in China. Whether directly or indirectly, what is happening in China impacts the companies we invest in. These companies will need to continue adjusting their businesses for the uncertainties ahead, including potential impacts to both supply and demand and other impediments such as tariffs. Having an understanding of what’s happening in China also allows us to prepare for the potential of rising volatility as the global economy and markets adjust to events such as a potential decoupling of China from the U.S. and other parts of the world.

To download this article, click here.