The Impact of Inflation: What factor types are better suited to withstand inflationary environments?

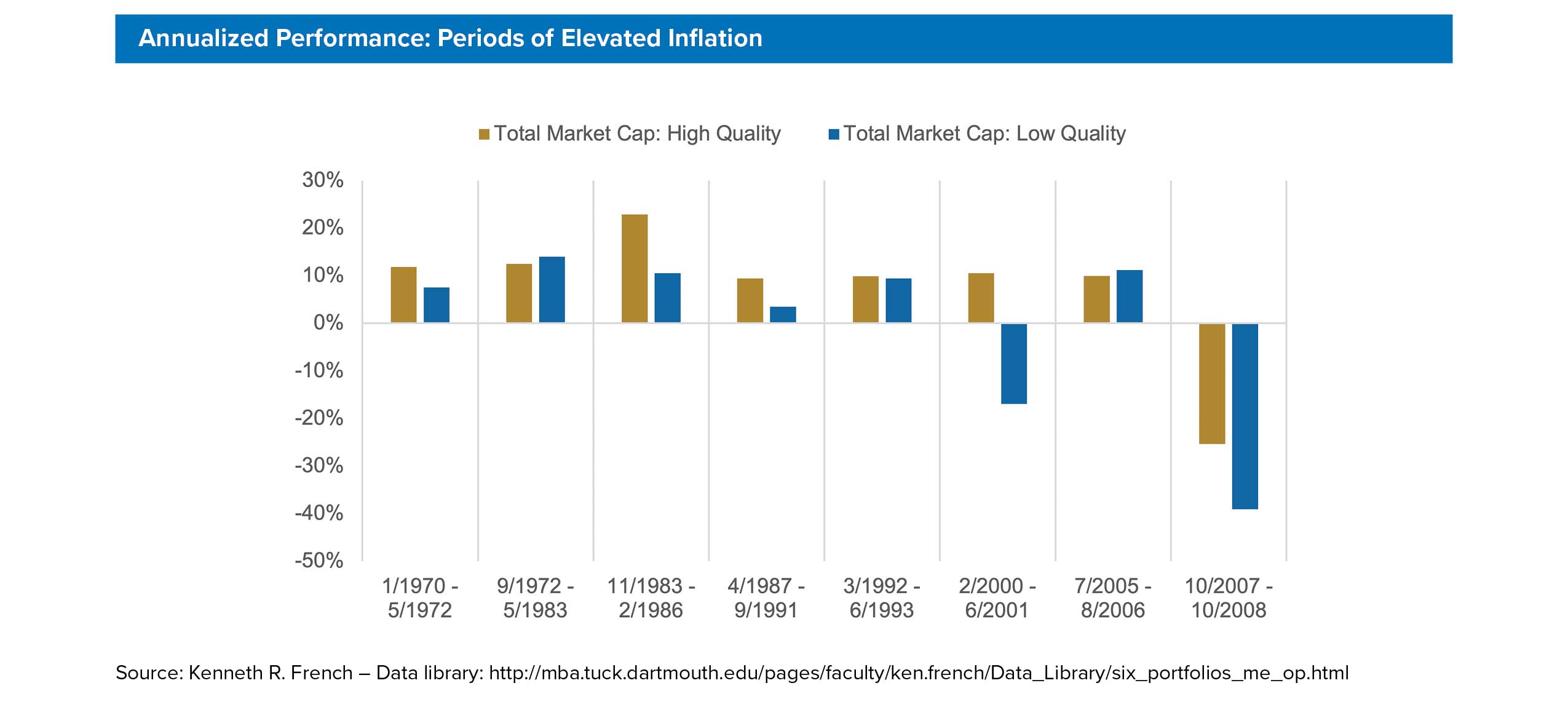

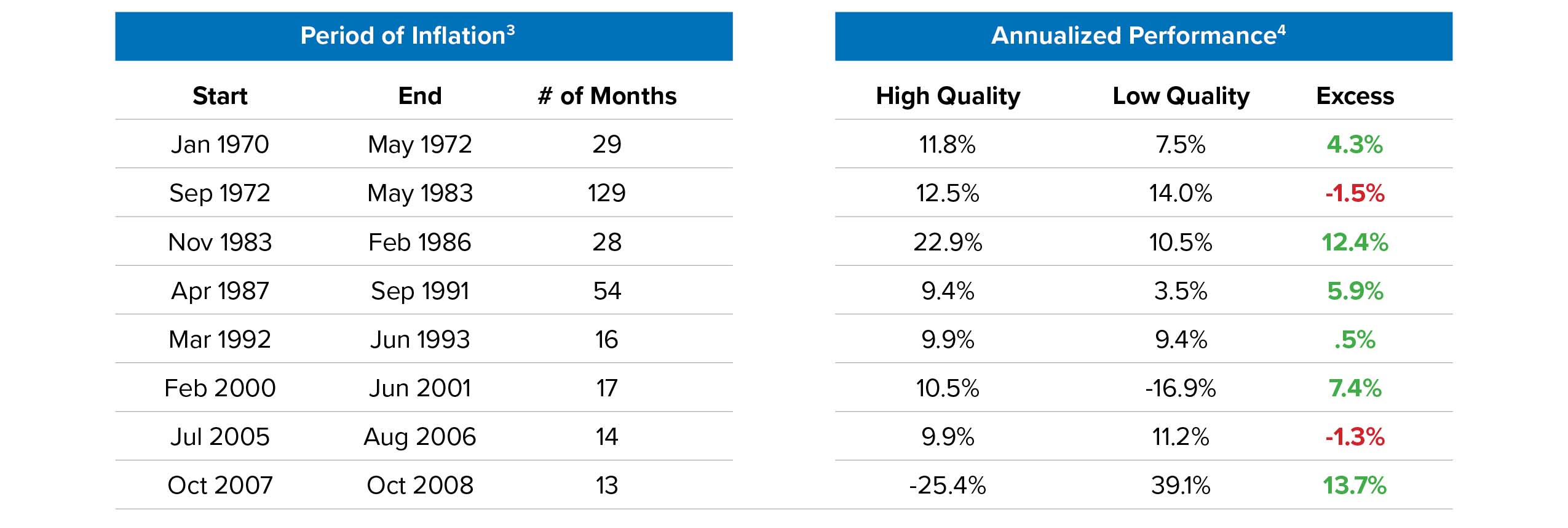

- We examined the performance of two portfolios – one constructed of high quality companies and the other of low quality companies – to determine how they behaved during periods of elevated inflation[1].

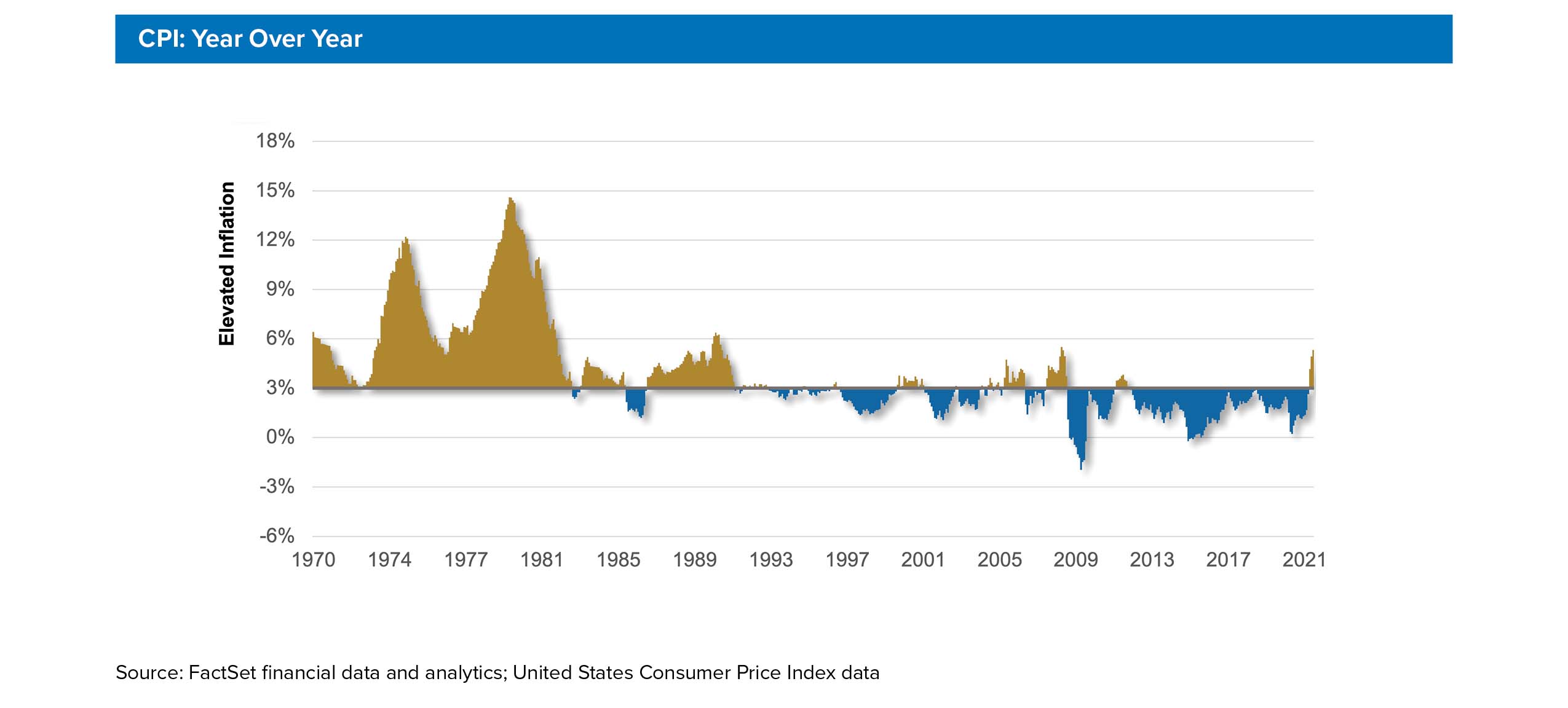

- We define elevated inflation as those periods where the U.S. CPI remained above 3% for a period of one year or longer [2].

- Using these parameters, we identified eight periods of elevated inflation within the past 50 years.

- During periods of elevated inflation, High Quality portfolios outperform Low Quality portfolios in six of eight periods:

- High Quality companies of robust profitability significantly outperformed their Low Quality counterparts during inflationary periods by an annual average of7%.

Key Takeaways

- Inflation has been on the rise in recent months, and we expect this trend to continue.

- Anchor Capital’s Quality Bias:

- Our fundamental investment process seeks to uncover high quality companies with defensive characteristics and identify these companies at reasonable valuations.

- We invest in companies that we consider to have strong management teams and governance practices who are incentivized on achieving long term success.

- Our intent is to partner with high quality, well-run companies and hold them in our portfolios for long periods of time.