The views expressed are those of Anchor Capital Advisors, LLC (“Anchor”) and are subject to change at any time. They are based on our proprietary research and general knowledge of said topic. The below content and applicable data are in support of our views on said topic. Please see additional disclosures at the end of this publication.

CHOOSING THE RIGHT CHARITABLE VEHICLE

Philanthropy in the United States has historically been driven by individuals, with over 80% of all donations in 2021 coming from individual donors. Average contributions have been steadily on the rise, with high-net-worth families donating an average of $29,269 per year, as have the percentage of American households who participate in philanthropy.1

Aside from gifting directly to charities, donor-advised funds (“DAFs”) and private foundations are two of the most commonly utilized charitable vehicles. While both offer immediate tax deductions upon contributing, they have significant differences with regards to administration, tax considerations, control, and multi-generational planning.

Defining Donor-Advised Funds

A DAF is an investment account held by a sponsor organization (i.e., Fidelity Charitable, Schwab Charitable). Once a donor funds a DAF, the assets become legally owned by the sponsor organization, and the donor moves into an advisory role where they will be able to recommend grants to IRS-qualified charities. DAFs have become increasingly popular due to their tax advantages and ease of administration. As of 2020, DAFs held $159.8 billion in assets.2

Defining Private Foundations

A private foundation is a separate legal entity used for charitable grantmaking. Unlike DAFs, a foundation is managed entirely by its Trustees or Directors, providing more control over its grantmaking, portfolio management, and administration. Foundations can be structured as either operating foundations or non-operating foundations. The former is actively conducting its own charitable activities, much like museums or libraries, while the latter is primarily involved in supporting other charitable organizations. For the purposes of this discussion, we’ll focus on non-operating private foundations.

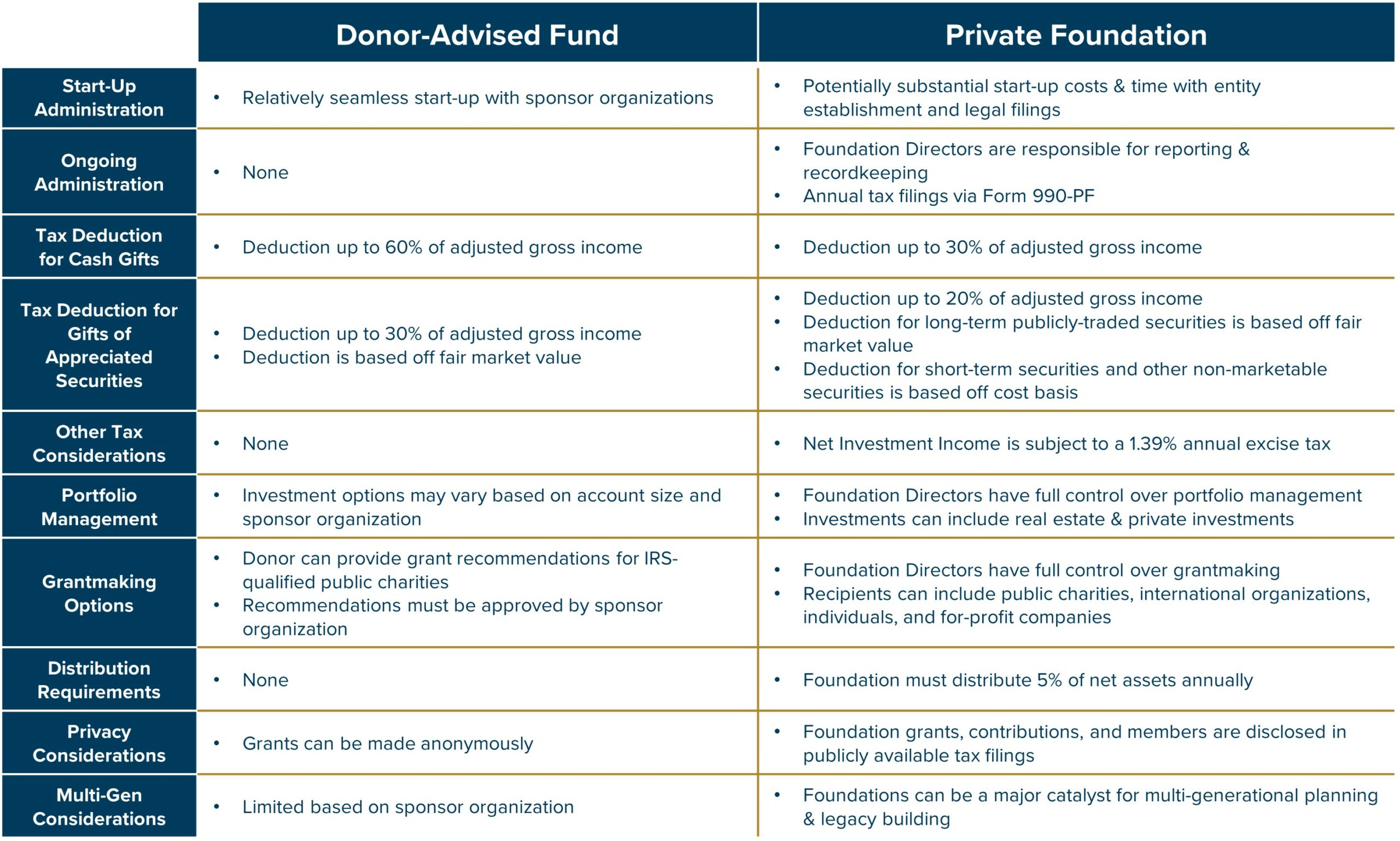

SUMMARY COMPARISON CHART

START-UP & ADMINISTRATION

Donor-Advised Funds

Establishing a DAF is a seamless process much like opening a brokerage account online. Most sponsor organizations do not require a set-up fee and may only ask for a deminimis initial contribution.

Once established, the sponsor organization will then be responsible for all record-keeping, reporting, and due diligence of charitable organizations.

Private Foundations

Private foundations can have extensive start-up costs. In addition to establishing a new legal entity with the state, donors must obtain its tax identification number and subsequently apply for private foundation status with the IRS via a Form 1023.

Additionally, foundations are governed by either a trust agreement or an Articles of Incorporation with bylaws, both of which require legal drafting.

On an ongoing basis, the foundation’s Directors are responsible for the record-keeping, reporting, due diligence of grant recipients, and annual tax filings via a Form 990-PF.

TAX CONSIDERATIONS

Donor-Advised Funds

Donors are afforded with a tax deduction in the year they contribute to a DAF, per the below limitations:

- Deductions for cash gifts are limited to 60% of the donor’s adjusted gross income.

- Deductions for gifts of appreciated securities are limited to 30% of the donor’s adjusted gross income.

Any unused deductions over the limit can be carried forward for five years.

Private Foundations

Donors are afforded with a tax deduction in the year they contribute to a foundation, per the below limitations:

- Deductions for cash gifts are limited to 30% of the donor’s adjusted gross income.

- Deductions for gifts of appreciated securities are limited to 20% of the donor’s adjusted gross income. If the appreciated security is a long-term publicly traded security, the deduction is based off the gift’s fair market value. However, if it is short-term or a non-marketable security (i.e., land, art, business interest), the deduction amount is based off the cost basis.

Any unused deductions over the limit can be carried forward for five years.

Additionally, private foundations are subject to a 1.39% excise tax which is applied against its net investment income.

GRANTMAKING PROCESS

Donor-Advised Funds

Donors can recommend grant recipients to the sponsor organization who has ultimate authority on the grantmaking. Recipients are limited to IRS-qualified 501(c)(3) organizations, and those which are on the sponsor organization’s approved list.

Private Foundations

Foundation Directors have complete control over the grantmaking process, and the range of grant recipients is larger than with DAFs. Foundations can provide grants for public charities, international organizations, direct scholarships for individuals, and even engage in program-related investments (“PRIs”) with for-profit organizations.

Gifting from a foundation also provides Directors with the ability to structure specific Pledge Agreements with binding restrictions, such as what the funds can be utilized for.

Notably, private foundations are required to distribute 5% of its net assets annually.

PORTFOLIO MANAGEMENT

Donor-Advised Funds

Investment options may be limited based on account size and the sponsor organization. For clients who have DAFs over $250K, Anchor Capital can manage the funds using our proprietary strategies.

Private Foundations

Foundation Directors have complete control over the entity’s portfolio management, and the investment universe can include real estate, private investments, and other alternative investments.

Those investing foundation assets in more complex investments should be mindful of unrelated business taxable income (“UBTI”) which are taxed at corporate income rates.

PRIVACY & ANONMITY

Donor-Advised Funds

Donors have the option to recommend grants anonymously, and contributions will always be made confidentially.

Private Foundations

As part of the annual Form 990-PF tax filing, foundations must disclose all grants, Directors, and donors who gave more than $5K in any given tax year. These tax filings become publicly available and are made easily accessible.

LEGACY & GENERATIONAL CONSIDERATIONS

Donor-Advised Funds

Sponsor organizations have recently been focusing on adding multi-generational planning capabilities to DAFs. These capabilities will vary across sponsor organizations and are subject to change. Many will allow donors to name an account successor who will take on the advisory role upon the donor’s passing. Notably, without a named successor the DAF assets are typically absorbed by the sponsor organization’s larger endowment.

Private Foundations

Foundations are powerful tools that can facilitate legacy building, multi-generational planning, and financial education for the next generation. Family members can be named as Directors or hold specific roles within the foundation, such as Treasurer or Secretary. These positions can be used to teach financial responsibility, philanthropic duty, and administrative responsibility. Depending on the size of the foundation and the work involved, it may also be appropriate to consider compensation for such roles.

Foundations, which abide by governing trust agreements or bylaws, can remain under family control for generations and establish a philanthropic legacy.

HOW ANCHOR CAN HELP

Determining which charitable vehicle is best for you is a decision that considers cost, tax profile, portfolio management, multi-generational planning, and legacy considerations. Contact your Private Client Advisor to help design the best philanthropic strategy for you.