“It’s been an ideal period for investors: A climate of fear is their best friend. Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance. In the end, what counts in investing is what you pay for a business – through the purchase of a small piece of it in the stock market – and what that business earns in the succeeding decade or two.”1– 2009 Berkshire Hathaway Inc. Annual Report

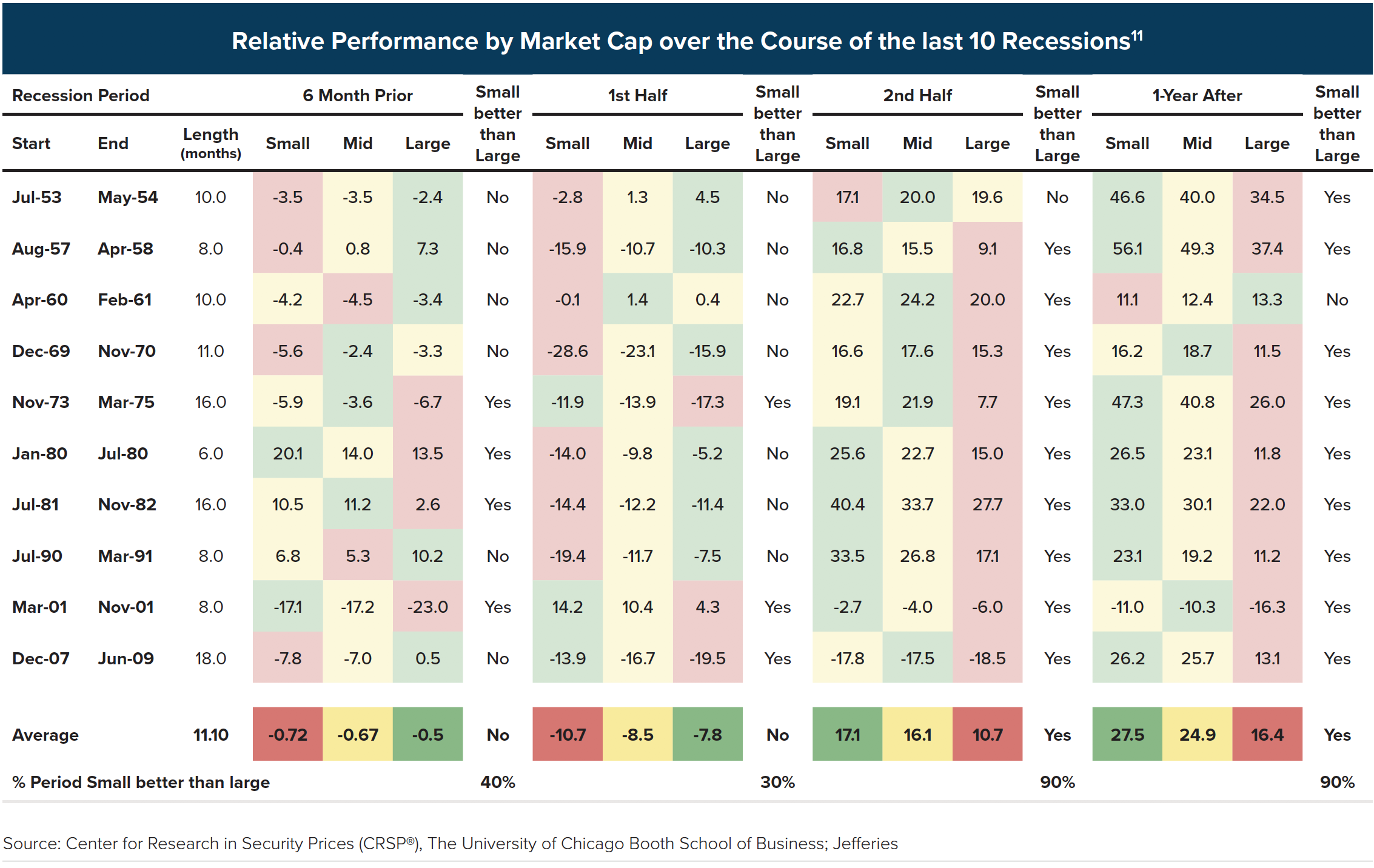

History indicates that small cap stocks beat large cap stocks coming out of a recession, and the outperformance begins well before the recession ends.2Small caps have bested large caps coming out of nine of the last ten recessions, with the outperformance beginning roughly halfway through the recession and lasting about a year after it ends.3Therefore, for long-term investors, we believe the first half of recessions is a favorable time to consider investing in small cap stocks. Typically, small caps underperform large for a period of time before the recession begins and suffer a steeper decline into it, but come out stronger. Timing a market is difficult, but we believe investors with a small cap risk tolerance should consider perceived recessionary periods as a time to invest in small cap stocks, especially small cap value.

Small Cap Returns Leading up to a Recession

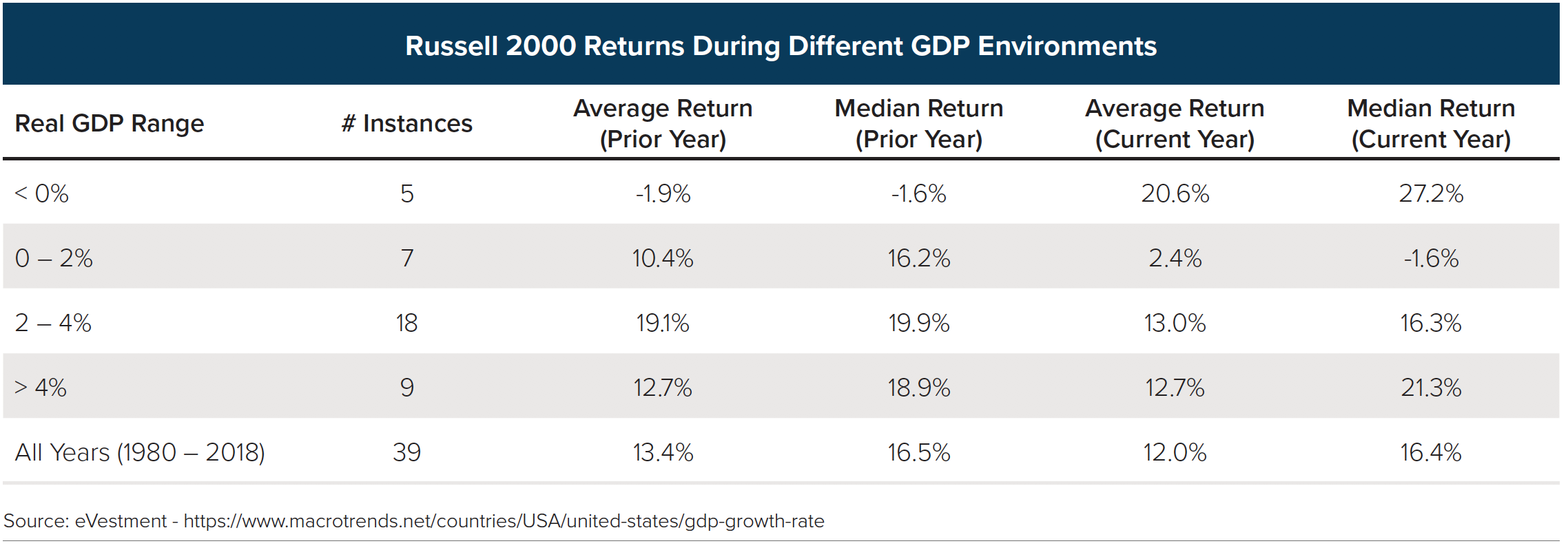

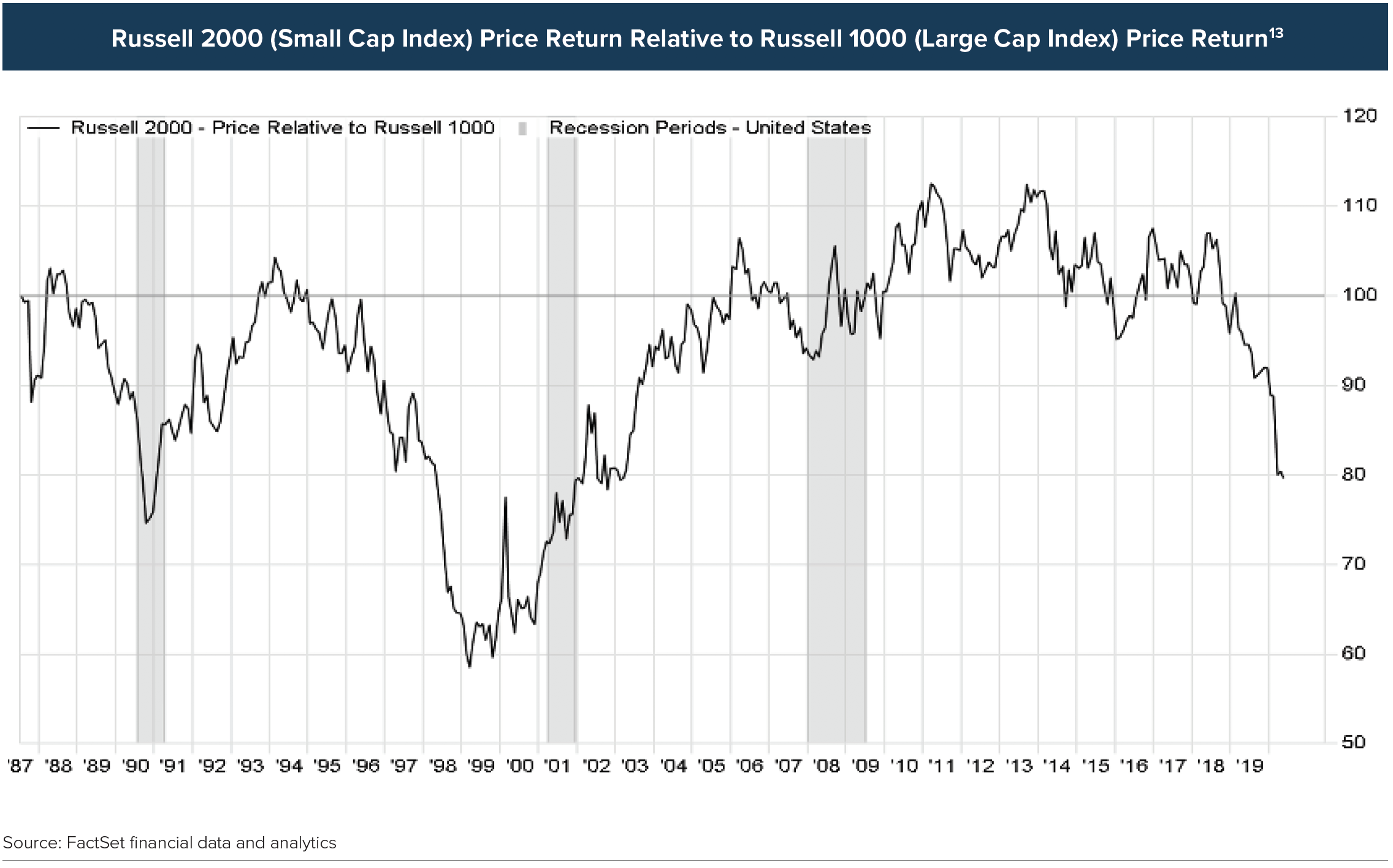

We see several drivers that contribute to small caps often underperforming large caps leading into a recession.4First, small cap stock performance is correlated with U.S. GDP. Small cap company financial performance is typically more aligned to the U.S. economy than large caps which can rely more on the global economy. As a result, when U.S. GDP declines slightly or is in the 0-2% range, small caps often underperform larger caps.5As an economic cycle matures, U.S. GDP growth may hover in that 0-2% range. Fund flows may also play into the underperformance. As investors become more cautious later in the market cycle with concerns about economic growth, fund flows from retail investors tend to go into the largest companies at the expense of small companies.6Small caps began to underperform the market as the housing bubble peaked in April 2006 and this lasted through 2008. More recently, they have underperformed large since 2016.

In general, small caps have higher leverage, a greater percentage of fixed rate debt, and shorter maturities than large caps, all leading to higher default risk.7Smaller companies more so than large companies, tend to have a higher exposure to cyclical industries.8During periods of fear and market volatility, such as the onset of a recession, investors will favor higher quality, more liquid companies. Investors may even exit the market altogether leaving small caps feeling the pinch more so than other market capitalization.9

Small Cap Returns Coming out of a Recession

As investors envision a potentially stronger economic environment, they are more willing to take on greater risk for a higher return, which small cap stocks may be able to provide. As noted, small cap sales, earnings, and cash flows are levered to better economic U.S. growth and when US GDP grows quickly, especially well above 2%, small caps tend to perform much better.10 When investors get a view of a recovery, small caps are positioned to recover more strongly.

Looking More Closely at the Data

The last 10 recessions have averaged approximately 11 months. In 70% of those recessions, small caps have lagged during the first half, or for the first five to six months. Starting in the second half of a recession, before the inflection point, small caps tend to outperform, and one year after a recession ends we’ve seen significant outperformance in small cap stocks. We never know how long a recession might last, but we are currently in one and believe investors should start to consider small caps.

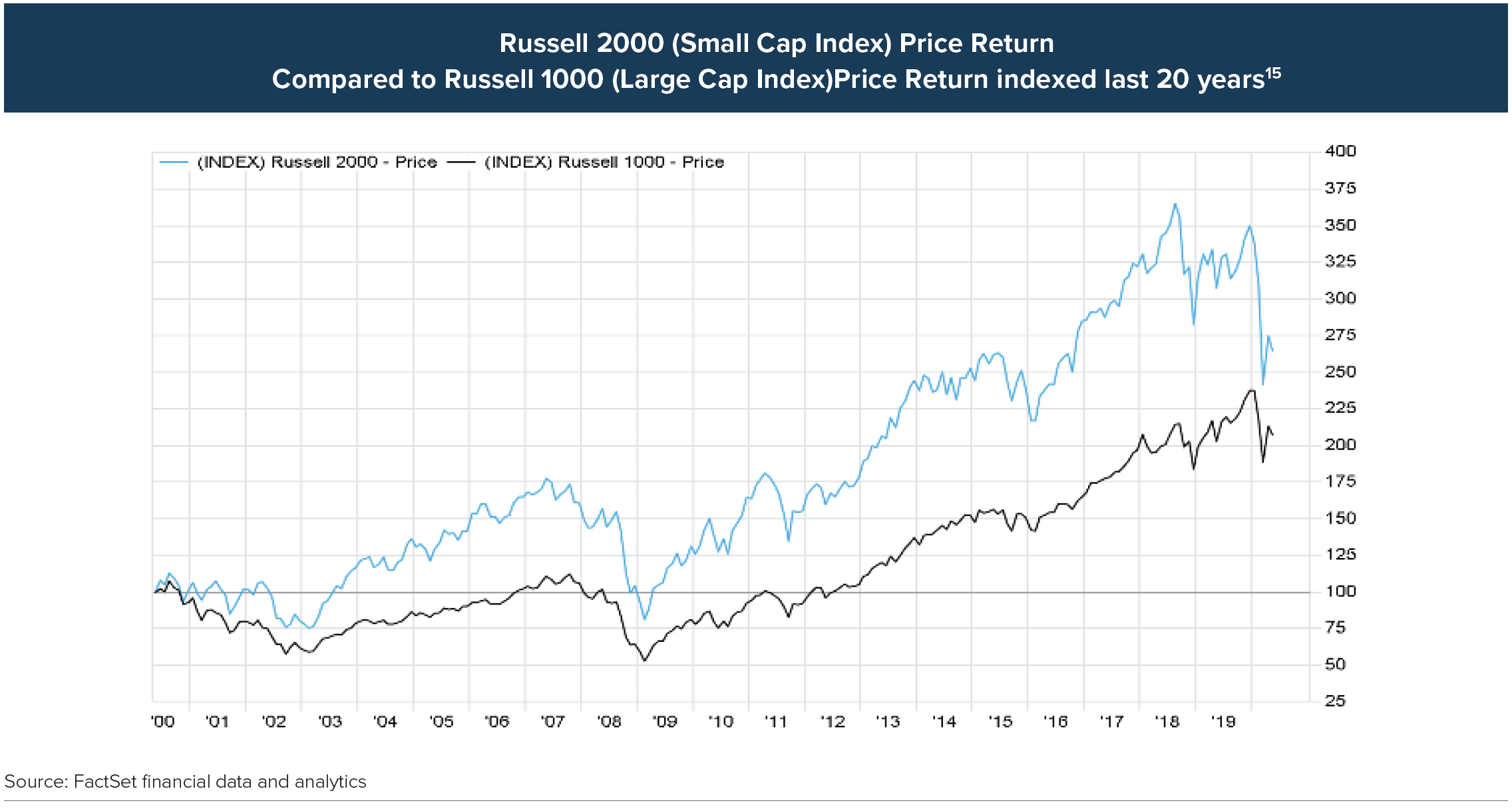

Viewing the returns over the past three recessions in graphic form, we can see small lags large late in the bull market, but recovers more during the recession.

In the current market cycle, small caps have underperformed large caps since 2016. This is consistent with a typical cycle whereby, on average, small cap underperformance lasts about four years.14 Over the long term, however, small caps have returned better than large caps. Therefore, we believe investors with a small cap risk tolerance should view the current environment as a potentially opportune time to consider small caps.

Small Cap Value Stock Performance During Recent Recessions

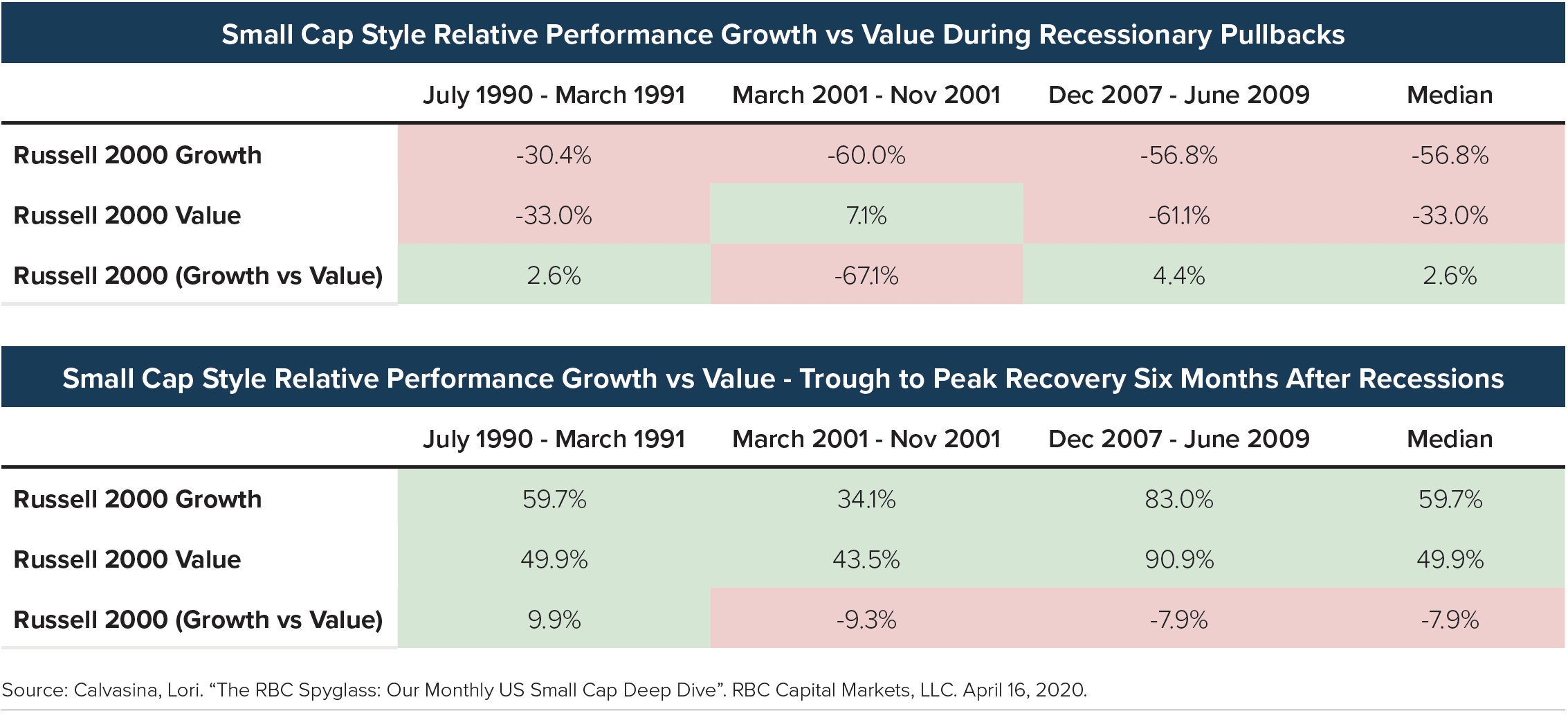

Looking more closely at distinct investment styles, namely value and growth, although small cap growth has out outperformed in two of the last three recessionary declines, value has bested growth in two of the past three recoveries.16

Russell 2000 Value versus Russell 2000 Growth Performance during Last Three Recession17

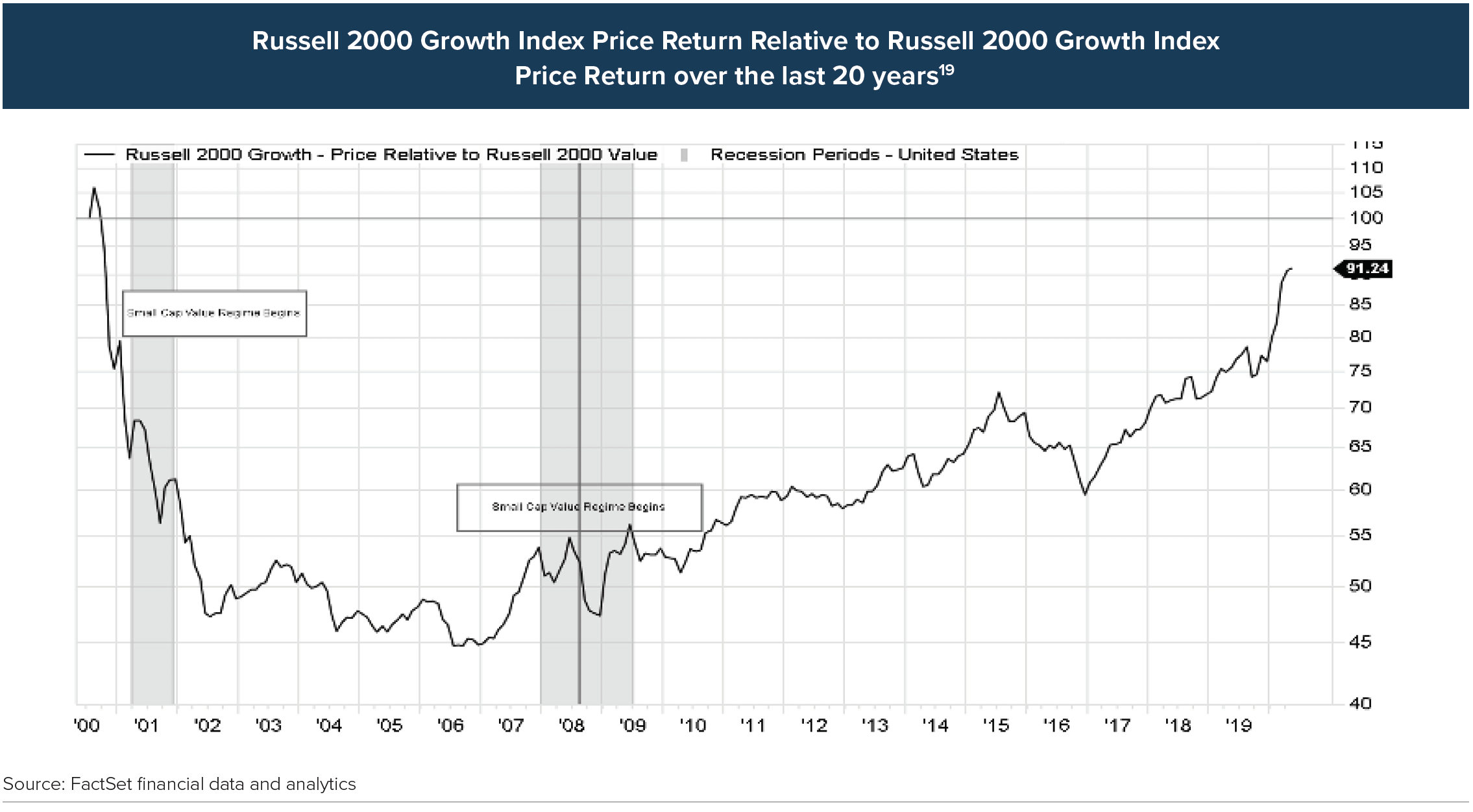

The last two shifts in small cap style preference transpired near peaks of the market.18 Assuming the market recently peaked, we may be on the verge of small cap value outperformance relative to small cap growth.

When to Move Toward Small Caps

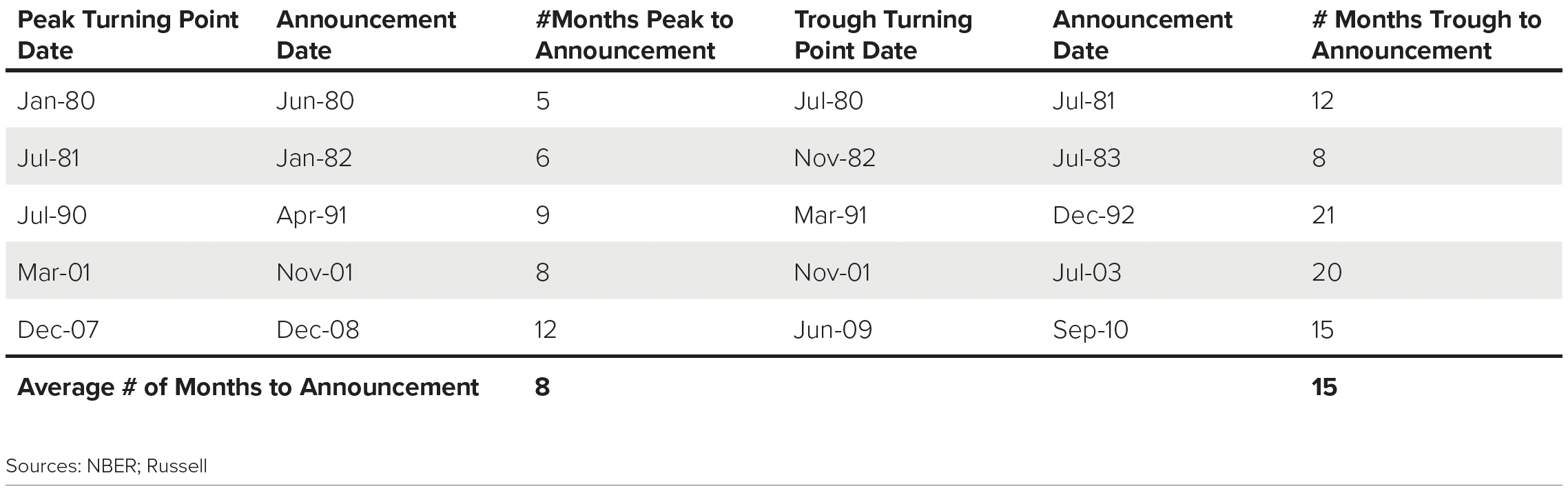

Waiting for official announcements from the National Bureau of Economic Research (NBER), most investors would miss some upside of small cap outperformance. Over the course of the last five recessions, the NBER called the market peak eight months on average after the actual peak and named the trough 15 months on average after the actual trough.20 Therefore trying to time inflection points of market cycles is challenging.21

We believe recessionary environments are favorable times to contemplate investment in small cap stocks as history indicates small caps tend to outperform larger caps before an economic recession ends. Small caps have outperformed large coming out of nine of the last ten recessions,22 and small cap value has beaten small growth coming out two of the last three.23Over long periods small caps have beaten large caps, and investing in them during a recession may help capitalize on their long-term outperformance.

To download this article, click here.