Value vs. Growth: Is There Still Value in Value Investing?

With equity markets reaching new highs, and high-valuation, big technology firms delivering the best performance1, some investors are questioning whether value investing is dead.

That question, however, only serves to remind us that tides can turn. “The last time value fell so deeply out of favor was around 1999,” notes famed investor, David Einhorn, “when everyone was talking about ‘eyeballs’ as the new paradigm for investing. That didn’t end very well [for momentum investors].” Einhorn went on to say that value investing is “due at some point for a significant recovery. When it reverts, it tends to revert pretty sharply. And I think it will do so.”2

We at Anchor share in this viewpoint.

What Is Value Investing?

Often associated with Graham and Dodd or Warren Buffet, the definition of value investing can vary between different investors and asset managers. At Anchor, we look for companies we believe are fundamentally sound, out of favor with investors, and trading at prices well below what we think they are worth. There can be several factors involved in why a stock is underpriced. The market often overreacts to various types of news, including a change in management, weaker-than-expected short-term financials, a shift in strategy or product, macro events such as hurricanes or fires, or even broader trends that can affect an entire sector. As a result, stocks may sell at low price-to-earnings, low price-to-book or low price-to-sales even though they may be great businesses.

It is essential, then, to find companies that are undervalued, not simply stocks that are “cheap.” Our research seeks to understand what will fundamentally drive a company’s revenue and earnings in a way that leads to higher future valuations. In our experience, value investing requires discipline and patience, sometimes requiring investors to wait many years for the investment thesis to play out. On occasion, it also requires taking a contrarian view to how the market is pricing the business.

On the opposite end of the spectrum, growth investors typically look for stocks with accelerating growth characteristics, and are willing to pay high prices for them relative to the broader equity market. They focus more on revenue growth than on valuation metrics such as earnings and cash flow. Historically, growth investing has exhibited more volatility than value investing.3

What Does History Tell Us About Long-term Value Investing?

Over the long run, stocks with certain value characteristics such as low price-to-asset value, low price-to-earnings, and a significant decline in price have provided competitive returns relative to the market.4

Louis Chan and Josef Lakonishok, in their work “Value and Growth Investing: Review and Update” looked at what we believe to be a wide swath of academic research on the topic, and with additional research they did from 1969 to 2001, concluded that value stocks, on average, earn higher returns than growth stocks.5

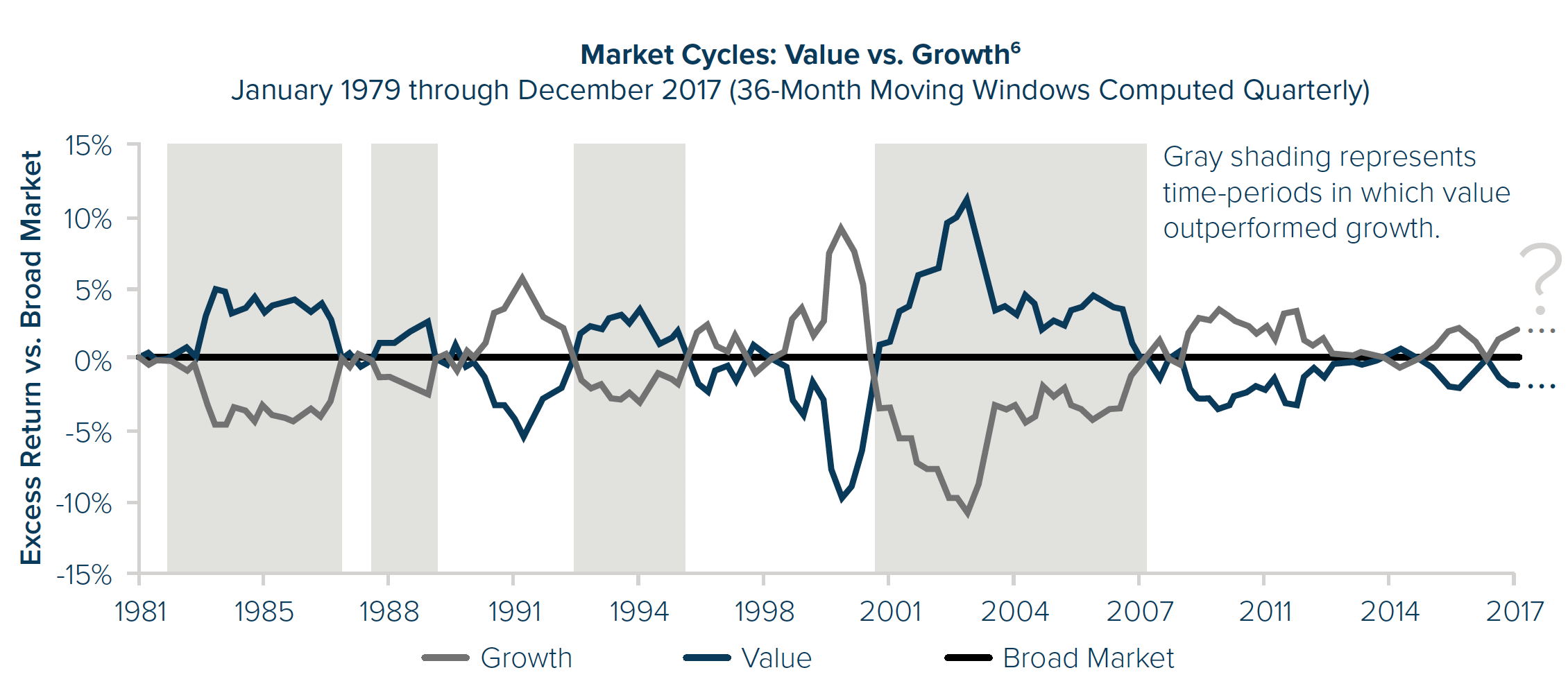

Value has outperformed growth before, and history suggests a correction may be overdue.

The chart above, which uses rolling three-year periods of quarterly returns beginning in 1979, illustrates the cyclical nature of outperformance between growth and value stocks. While history shows the duration of a typical cycle is three to five years, the current growth cycle has been going on for much longer. In fact, it has been almost a decade since we last experienced a significant value trend. These historical patterns in investment style behavior may suggest that a reversal of recent trends could be imminent.

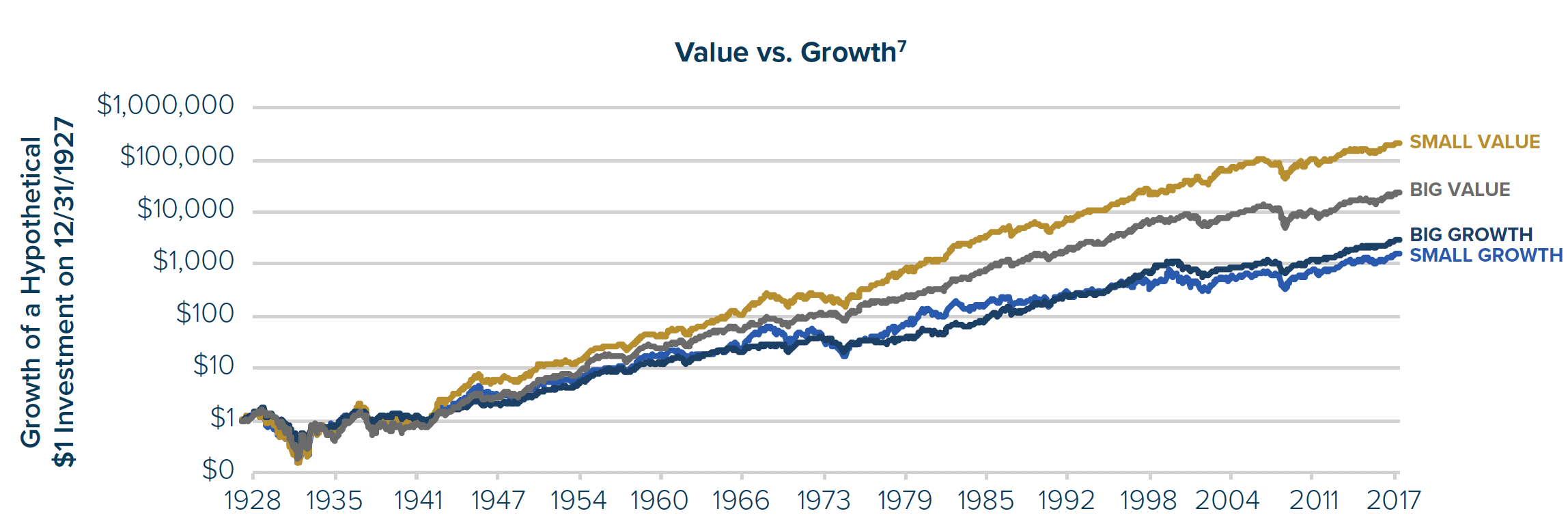

During the previous five year periods when growth outperformed value, value subsequently delivered results above growth and the S&P500 over the next five years. In this current market cycle, the value rebound has not yet occurred. Over the past 90 years, from 1927 to 2017, value has outperformed growth. One dollar invested in 1927 in large-cap value stocks would total $20,545 today. The same dollar invested in large-cap growth over the same period would amount to only $2,343. Similarly, one dollar invested in small-cap value stocks over the period would be $199,989, versus $1,265 in small-cap growth.7

There are a few key takeaways best highlighted by Advisor Perspectives authors John Alberg and Michael Seckler:

The first is that periods of underperformance of value strategies have not erased superior results over the long term. The second is when value strategies have underperformed, they have subsequently delivered very strong absolute and relative returns. Finally, that value investing has done well over time, but has not worked all the time, and this reflected an important point: periods of underperformance make value strategies difficult to stick with. If value investing was both fruitful and easy, more would embrace it, and the opportunity to do well…would be competed away.8

In our view, the success and long-term results offered by value strategies typically accrue only to those who persevere across difficult periods, never losing site of value’s downside protection and its subsequent opportunity when the cycle shifts back the other way.

Why Has Growth Been Outperforming Value This Time Around?

Our analysis points to four factors that may explain why investors have flocked to growth stocks rather than value stocks over the recent period.

Investors have become obsessed with revenue over profitability. Around the world, investors have favored stocks with strong expected revenue growth, driving the price of high-valuation growth stocks even higher. In the minds of investors, topline growth has superseded profitability, even if the latter is what drives long-term business value. As in the late 1990s, another time period when growth outperformed value, some observers wonder whether business valuation has less to do with profits than with a company’s ability to be disruptive, provide social change, or advance technologies, even if doing so leads to future losses.9

Volatility has remained low. Studies have shown that growth stocks outperform value stocks in periods where there is low volatility, as measured by the VIX.10 Conversely, greater volatility may be expected to change that.

Anemic global growth has made investors hungry for fast growing companies, in our view. Our reading of the past decade suggests the following scenario: A long period of weak global economic conditions led to a greater emphasis on finding companies that were still able to grow revenues and earnings, causing many investors to gravitate toward growth stocks. This allocation may seem like a reasonable response to the recent environment. However, it can also lead to unwarranted valuations, even for the fastest-growing companies, as everyone flocks to the same stocks at the same time.

There has been a reach for risk. Global financial markets have been facing ultra-low interest rates and unconventional monetary policies conducted by central banks around the globe. We believe this has led to a reach for risk, leading many to be in favor of higher risk, higher volatility, and growth stocks.

What Could Change The Tide?

With that background, what could initiate a correction back toward value? In our opinion, there are a few potential causes worth mentioning.

Missed growth targets. Most growth companies now face ever-higher growth targets. The higher a target, the easier it is to miss. At the same time, growth stocks have become more expensive than at any time since the technology stock bubble, based on a variety of valuation metrics. For example, the PEG ratio, a metric to gauge what investors are willing to pay based on a company’s earnings growth, reached its highest level since 1995.11 High multiples limit the future return potential for growth stocks. In addition, if stocks miss their growth forecasts, those multiples also make them particularly vulnerable to sharp declines. A string of misses by growth stocks, due either to their own fundamentals or to macroeconomic factors, could potentially lead to the return of value outperformance

Rising uncertainty. A stock’s value is the present value of its future cash flows. It is more difficult to assess those flows for a growth stock during times of uncertainty or fear. A major change in the economy or an increase in market volatility (as measured by the VIX)12 would likely have an outsized impact on growth stocks, especially since our research shows that growth stocks have historically exhibited more volatility than their value cousins. If greater uncertainty returns, value should once again outperform growth.

Rate hikes. Rising interest rates could lead to lower stock valuations in general, given that they depend on using interest rates to discount a company’s future earnings or cash flows. For growth stocks in particular, decreases in valuation could be even more pronounced.13

Why Anchor Capital Stays True To Its Long-Term Value Approach

As value investors for 34+ years, we at Anchor Capital have witnessed many periods where growth has outperformed value, including the technology bubble in the 1990s. In all that time, the firm has stayed true to our value-oriented approach and discipline, knowing that value has outperformed growth in the long run while providing better downside protection.

During a market boom, even professional investors can get caught up in the fear of missing out. But we believe that the key to success is having patience and maintaining a long-term horizon. We think history attests to the truth of this statement.

That seems especially true in this current market, which seems quite overdue for a change in gears. Valuations are at all-time highs, and earnings growth rates are slowing. Although we are not market forecasters, and never will be, we do believe it best to be prudent in market conditions like this, and to realize that a shift to value is bound to occur sooner rather than later.

Click here to download the PDF.