The views expressed are those of Anchor Capital Advisors, LLC (“Anchor”) and are subject to change at any time. They are based on our proprietary research and general knowledge of said topic. The below content and applicable data are in support of our views on said topic. Please see additional disclosures at the end of this publication.

While many individuals keep a checklist of financial items to tackle at the end of the year, such as tax-loss harvesting and writing checks to family members, there are often strategies that are missed by not taking action throughout the year.

As we approach the holiday season, many individuals are beginning to tackle items on their year-end checklist, such as tax-loss harvesting and writing checks to family members. Charitable gifting is often an afterthought left for the last minute, with approximately 12% of all annual gifts occurring in the last three days of the year,[1] despite the fact that the Tax Code offers various benefits related to philanthropy. These benefits have helped incentivize charitable gifting by Americans. According to a recent study, total donations have increased every year since 1977 apart from three post-recession years.[2]

Individuals can take advantage of these tax benefits by utilizing charitable vehicles such as Donor-Advised Funds, selecting assets that are best to gift from a tax perspective, and understanding how to maximize their charitable deduction.

Determining the best gifting method requires careful planning given ever-changing tax laws and volatile market conditions. As an example, the 2022 tax year saw two charitable benefits recently created by the CARES Act expire. Non-itemizing taxpayers will no longer be afforded with a special $300 charitable deduction, and those who itemize will see their eligible cash contribution deductions once again limited to 20% – 60% of their adjusted gross income.

For individuals staring down large Required Minimum Distributions, and subsequently large tax bills, exploring Qualified Charitable Distributions (“QCDs”) may provide unique benefits. Sometimes referred to as IRA Charitable Rollovers, QCDs are an often-forgotten charitable gifting method that helps to reduce the tax burden of mandatory Required Minimum Distributions (“RMDs”), which are taxed at the higher ordinary income rates.

To effectively utilize this strategy, individuals should explore these charitable distributions before any RMDs are made. In other words, planning ahead for the calendar year should provide more options and more opportunitites.

HOW DO QUALIFIED CHARITABLE DISTRIBUTIONS WORK?

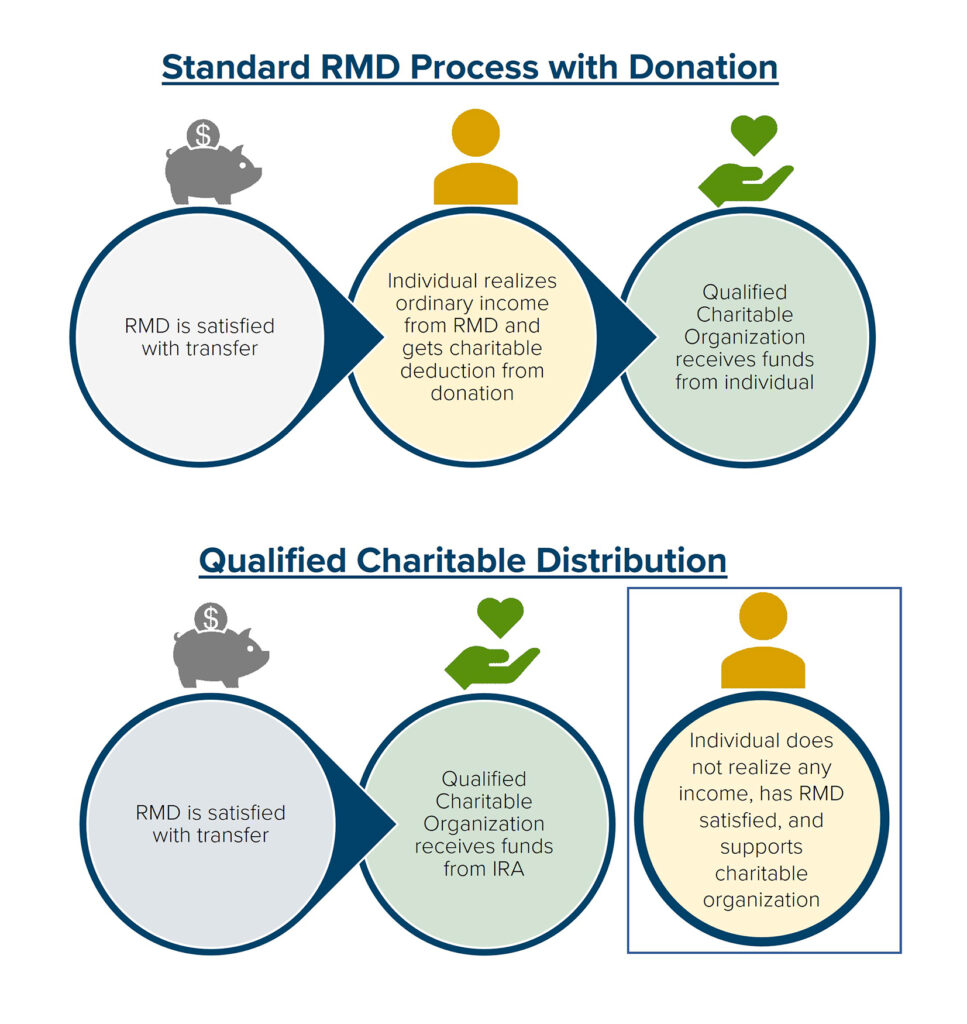

QCDs are direct charitable gifts made from an IRA. The QCD’s benefit is that the amounts gifted will count as part of the outstanding RMD, while excluding said amounts entirely from taxable income. It’s important to note that its exclusion also means the individual cannot claim a charitable deduction as it would be seen as “double dipping” benefits.

The below illustration compares the QCD process with the process of withdrawing RMDs and subsequently gifting to a charity:

ELIGIBILITY & REQUIREMENTS

- Individuals must be 70½ years of age or older to be eligible. While the eligibility age is 70½, we note the RMD age was recently raised to 73, with plans to subsequently increase to 75 in 2033. Therefore, the real benefits of this strategy are felt after RMD age.

- QCDs must be made directly from an IRA. To qualify as a QCD, gifts must be made directly out of the IRA. Withdrawing the funds from your IRA and subsequently gifting to charity will be ineligible, and the individual may be subject to ordinary income on the withdrawal amount. Additionally, Traditional IRAs, Inherited IRAs, SEP IRAs, and SIMPLE IRAs are all eligible to make QCDs, while employer-sponsored retirement plans (i.e., 401(k) Plans, 403(b) Plans) are not.

- QCDs must be made to a Qualified Charitable Organization. Gifts must be made to eligible charitable organizations, as defined by the IRS. The IRS provides an online resource to confirm eligibility, noting Donor- Advised Funds, private foundations, and supporting organizations are ineligible. Of note, the SECURE Act 2.0 included provisions that would allow for a one-time QCD of up to $50k to a charitable remainder trust or charitable gift annuity.

- QCDs are limited to $100K per year. If a taxpayer is married and filing jointly, the spouse will also be afforded another $100K limit to make QCDs from their own IRA. While this limitation is static, we note there is currently a bill in Congress that would begin indexing this figure for inflation.

- Reporting Requirements. QCD amounts will be reported on a Form 1099-R. As custodians are not required to specify QCD transactions on their tax forms, it is critical for the gift to be correctly characterized on that year’s tax return.

BEST PRACTICES

Because there are many options for charitable gifting, a comprehensive review would be recommended in order to determine the best plan of action.

Generally, exploring QCDs are appropriate for those who are subject to RMDs, but do not need the additional funds. Utilizing QCDs would allow the individual to satisfy their RMD, reduce their taxable income, and continue supporting charitable organizations.

Additionally, eligible individuals who find themselves on the cusp of two tax brackets may want to explore QCDs as a method of staying in the lower bracket. This becomes especially beneficial should the taxpayer be nearing income phaseouts for certain deductions and/or credits, or should they be able to reduce their Medicare Part B premiums by lowering their Modified Adjusted Gross Income.

For those who ultimately decide to pursue this strategy, it’s important to coordinate QCDs with RMDs as IRAs follow a “first-dollars-out” rule. This rule states the first dollars withdrawn from an IRA are deemed to be part of the RMD, as opposed to characterizing aggregate figures at the end of the tax year. In other words, the initial RMD withdrawals cannot be retroactively characterized as the QCD. Without proper coordination, taxpayers may find themselves inadvertently subject to additional taxable income amounts, which is why we believe planning ahead for strategies such as QCDs is critical.

HOW ANCHOR CAN HELP

Determining the best charitable gifting strategy requires a comprehensive review of your financial situation. As Qualified Charitable Distributions come with various reporting and administrative requirements, your Anchor team will help review your situation and facilitate said requirements along the way. Contact your Private Client Advisor to help design the best gifting strategy for you.